Crypto

•

2 mins read

•

April 02, 2023

Coinbase Fees: A Detailed Guide

Here’s the full breakdown of all fees charged by Coinbase

Coinbase Fees: A Detailed Guide

One of the US exchanges, Coinbase, charges high fees to its users. Here’s a quick and detailed breakdown of all the different types of fees charged by Coinbase and alternatives you can choose from.

Account Fees

Coinbase doesn’t charge any fee for creating an account.

Trading and Transaction Fees

Coinbase charges a dynamic base fee when you use the buy, sell, or convert feature on its platform.

The dynamic fee is based on a combination of different components,

- Standard flat fee (1%)

- Spreads

- Size of the order

- Market conditions, such as volatility and liquidity.

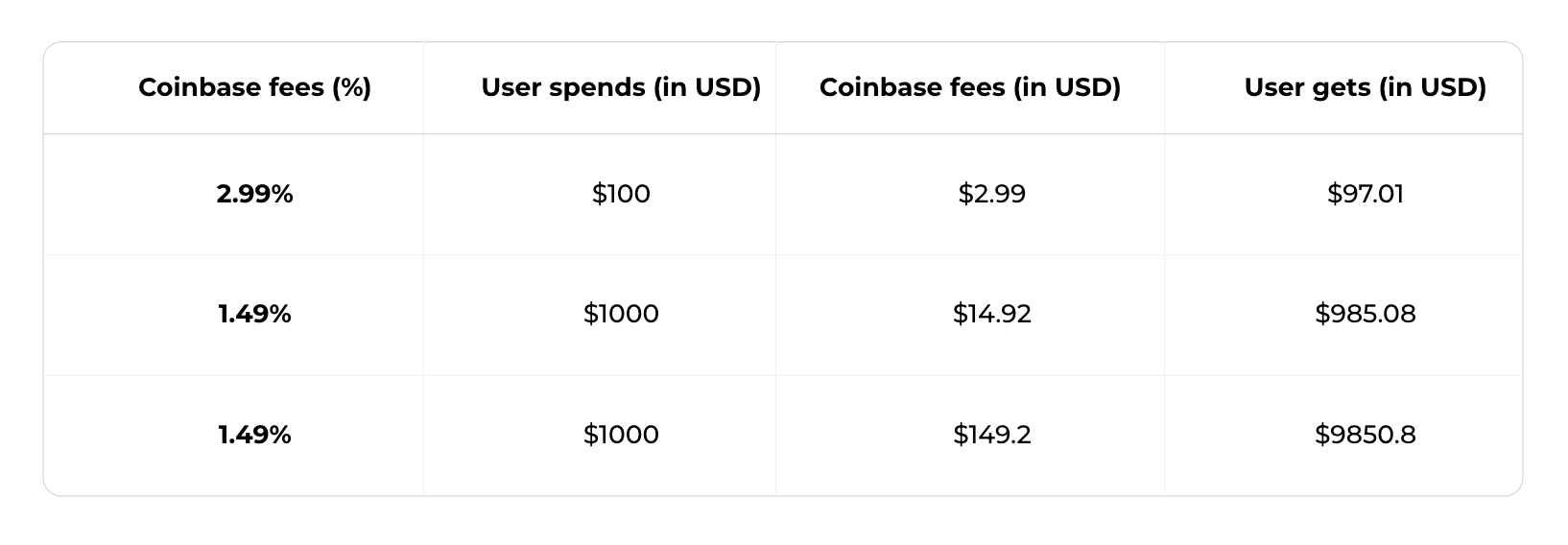

Whenever you place an order on Coinbase, you will see your fee in the trade preview section. Here, you get an estimate of how much you are charged —the expected fee ranges are as follows.

Note - the above section only includes trading/transaction fees and excludes additional fiat deposits/withdrawal fees

On the Coinbase Advanced Trade section, the fee component is standardized, depending upon the users’ trading volume, and it doesn’t include spread fees as the orders are placed and matched directly with its order book.

- For market makers, the fee range starts from 0.4% (0 to $10k trading volume) to 0.00%(+ $400M)

- For takers, the fee range starts ranging from 0.6%(0 to $10k trading volume) to 0.05%(+$400M)

- For stable pairs, the maker and taker fees are standard 0.00% and 0.001%, respectively

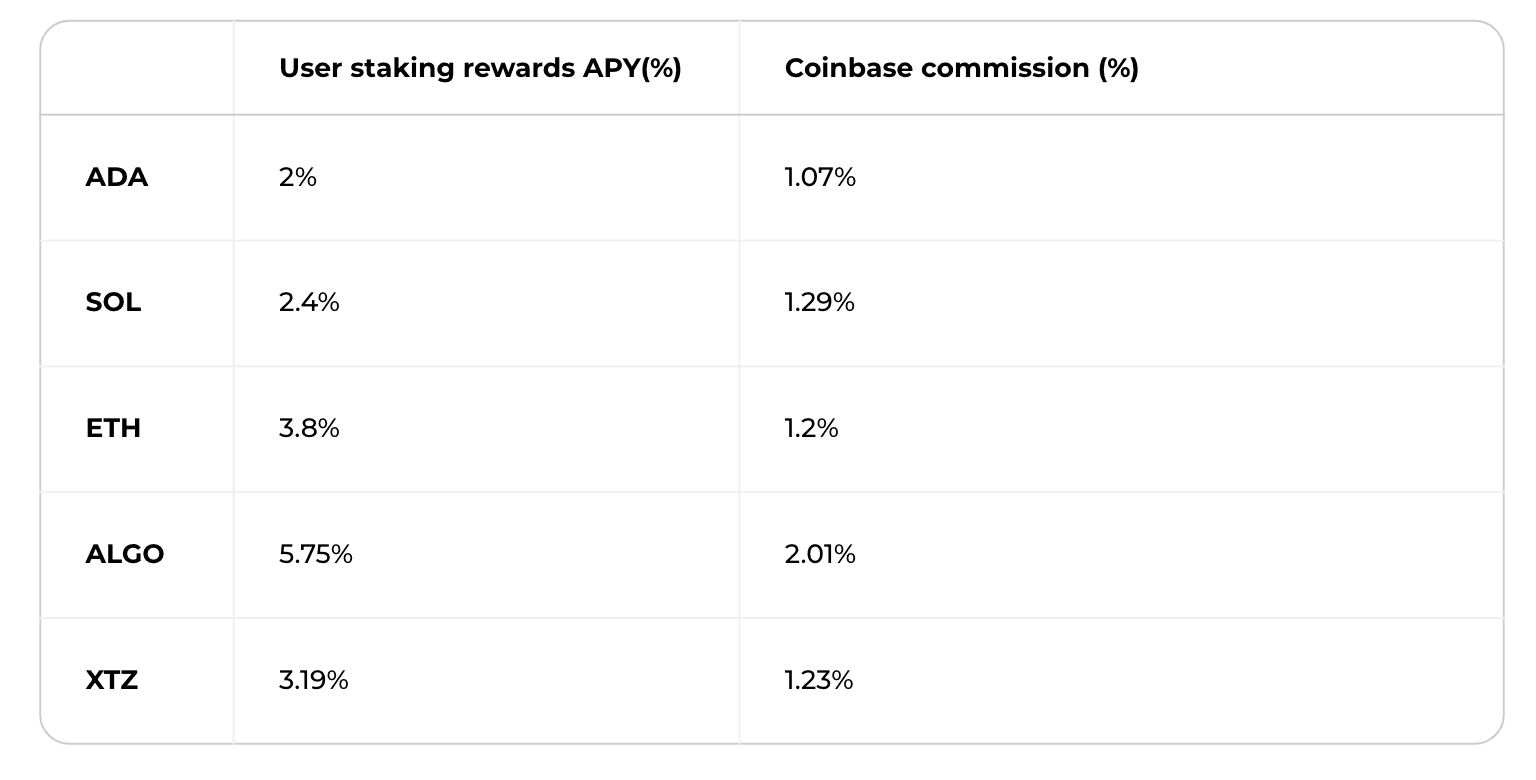

Staking fees

Coinbase doesn’t charge direct fees for staking, but charges commission on rewards one earns on the staked coins periodically. Commission rates fluctuate and differ for every stake coin ranging as follows.

Note - Staking rewards APY(%) on Coinbase are lower in comparison to direct staking on respective blockchain networks, as Coinbase takes a percentage commission on staking rewards. Coinbase commission defined in %(percentage) is based on approximation.

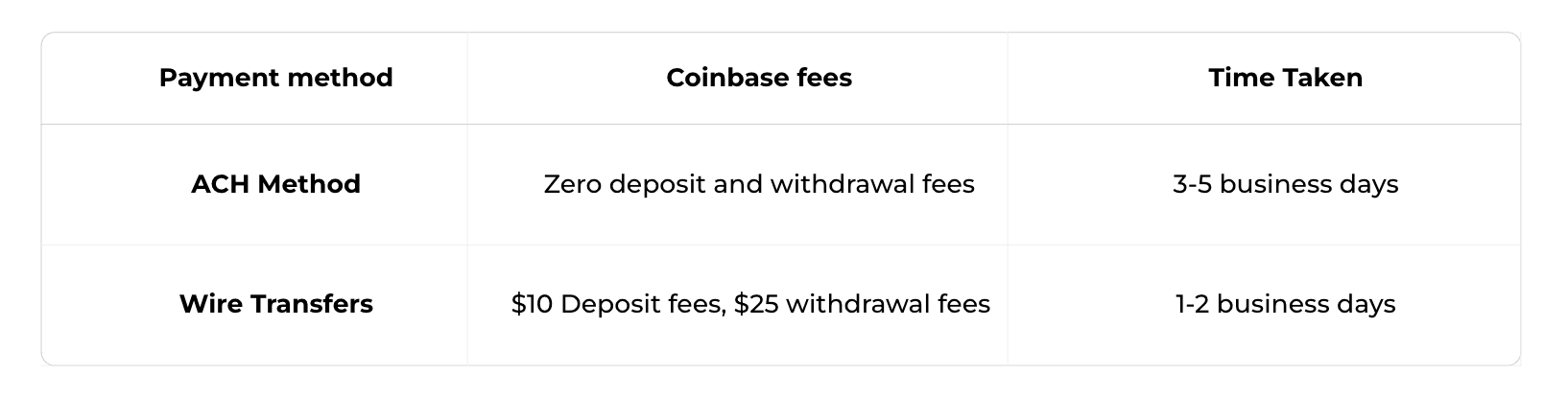

Fiat Deposit and withdrawal fees

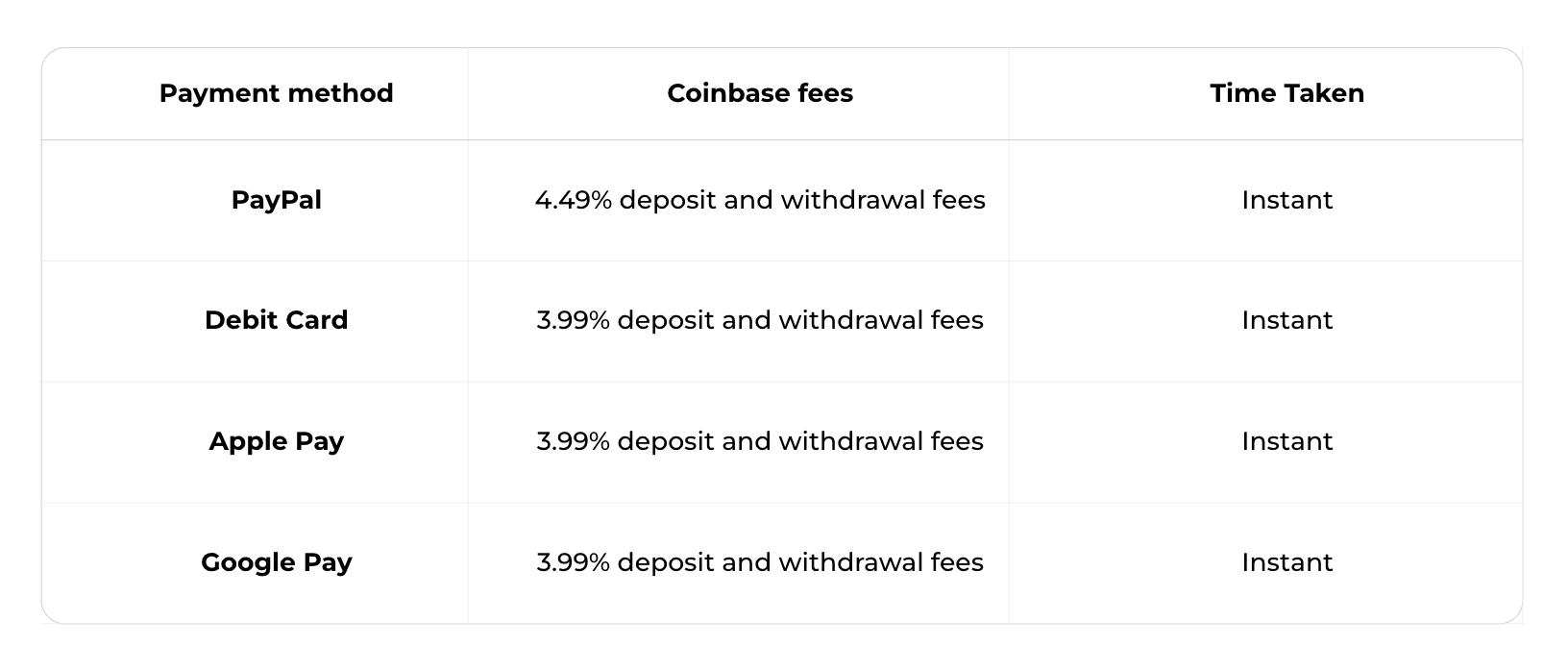

On Coinbase, every payment method comes with its respective deposit/withdrawal fees.

For quick transfers and instant funding, you can use the following methods

Remember that the above charges are only for depositing fiat(USD).

For example, to buy crypto worth $100 via PayPal, you will have to pay a $4.49 fee for depositing USD and an additional $2.99 to purchase crypto, $7.48 cumulatively in fees.

Crypto Deposit and withdrawal fees

Coinbase doesn’t charge additional deposit fees. For crypto withdrawals, you will have to pay standard network or withdrawal fees depending on where you are transferring your crypto from.

Need an account without high fees or anxiety? We're here to help

Juno is America’s most powerful account, where going from cash to crypto is easy, affordable, and instant.

To summarize, the Juno account offers

- 5% yearly bonus on cash deposits up to $25k and a 4% yearly bonus on cash deposits over $25k and up to $250k

- Buy and sell 35+ crypto assets directly from your account

- No holding periods on crypto withdrawals

- Quick and Hassle-free customer support

to get your journey started.

Disclaimer - Please note that the information provided regarding various fees is sourced from official channels and is subject to change as per the evolving business requirements

QUICK LINKS

Crypto Platforms and Exchanges Fees and Charges

How to close exchange accounts

Kunal Shivalkar

Kunal is a crypto native marketer and content writer