Crypto

•

2 mins read

•

April 03, 2023

Bitstamp Fees: A Detailed Guide

Here’s the full breakdown of all fees charged by Bitstamp

You can choose from numerous crypto platforms and exchanges in the US. What’s important is to evaluate how much fees and what different kinds of fees they charge so it doesn’t put a dent in your pocket when you buy Bitcoin or crypto every time.

One of the US crypto platforms, Bitstamp, charges high fees to its users. Here’s a quick and detailed breakdown of all the different types of fees charged by Bitstamp and alternatives you can choose from.

Account Fees

Bitstamp doesn’t charge any fee for creating an account.

Trading and Transaction Fees

On the Bitstamp section, the fee component is standardized, depending upon the users’ trading volume. It doesn’t include spread fees as the orders are placed and matched directly with its order book.

- For market makers, the fee range starts from 0.3% (from $1k to $10k monthly trading volume) to 0.00% (+ $1 Billion)

- For takers, the fee range starts ranging from 0.4%(from $1k to $10k trading volume) to 0.03% (+ $1 Billion)

- For stable pairs, the maker and taker fees are standard 0.00% and 0.01%, respectively

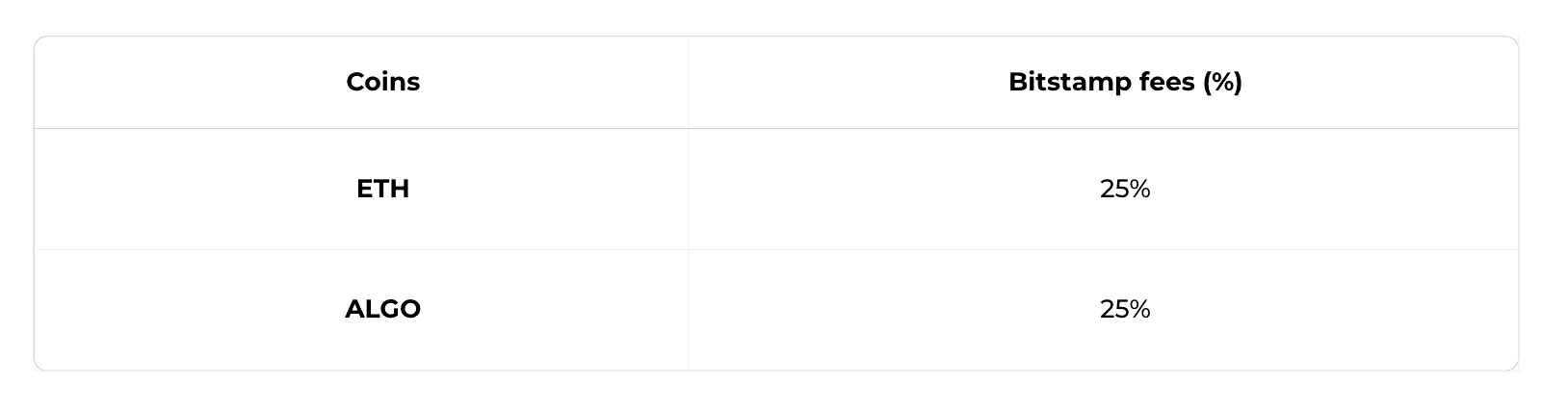

Staking fees

Bitstamp doesn’t charge direct staking and unstaking fees but takes a commission on the total reward pool collected by staking nodes run by Bitstamp. Bitstamp pools in user funds and run a staking node, and they get staking rewards that they pass on to their users.

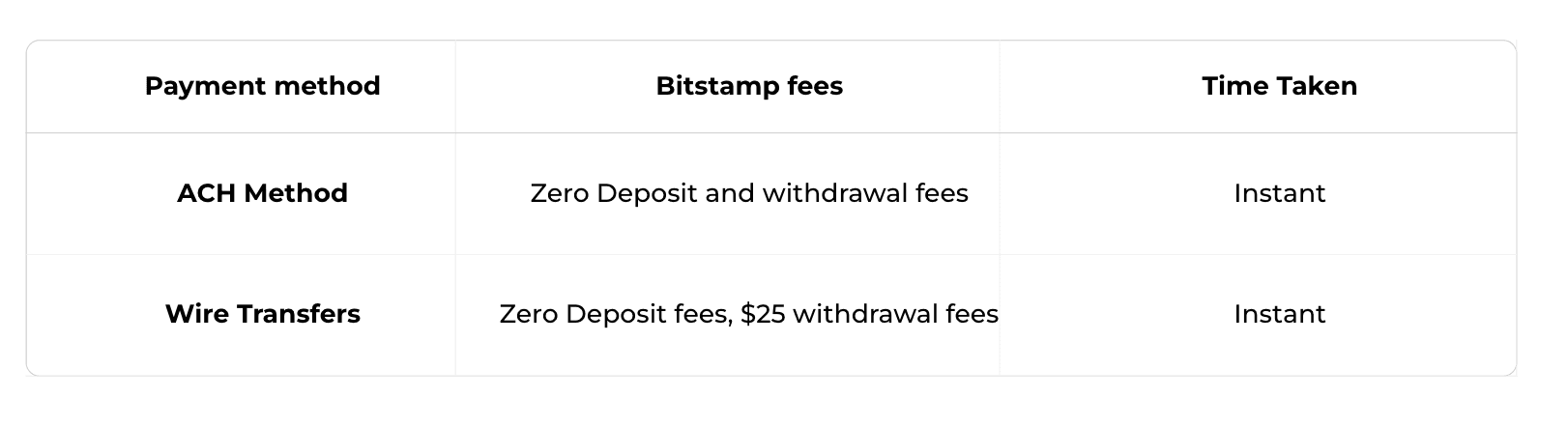

Fiat Deposit and withdrawal fees

On Bitstamp, every payment method has its respective deposit and withdrawal fees and respective waiting time.

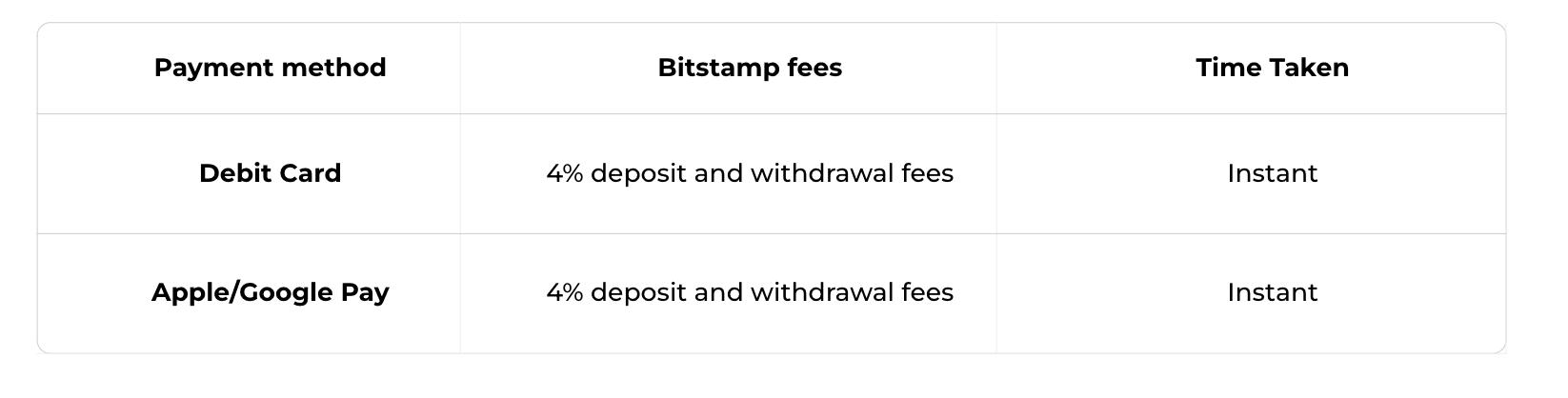

For quick transfers, you can use the following methods.

Remember that the above charges are only for depositing fiat(USD).

For example, to buy crypto worth $100 via a Debit card, you will have to pay a 4% fee for depositing USD and an additional trading fee(based on trading volume tiers) to purchase crypto.

Crypto Deposit and withdrawal fees

Bitstamp doesn’t charge additional deposit fees. For crypto withdrawals, you will have to pay standard network or withdrawal fees depending on where you are transferring your crypto from.

Need an account without high fees or anxiety? We're here to help

Juno is America’s most powerful account, where going from cash to crypto is easy, affordable, and instant.

To summarize, the Juno account offers

1. 5% yearly bonus on cash deposits up to $25k and a 4% yearly bonus on cash deposits over $25k and up to $250k

2. Buy and sell 35+ crypto assets directly from your account

3. No holding periods on crypto withdrawals

4. Quick and Hassle-free customer support

to get your journey started.

Disclaimer - Please note that the information provided regarding various fees is sourced from official channels and is subject to change as per the evolving business requirements

QUICK LINKS

Crypto Platforms and Exchanges Fees and Charges

How to close exchange accounts

Kunal Shivalkar

Kunal is a crypto native marketer and content writer