Product Updates

•

2 mins read

•

April 26, 2023

How to pay your AT&T bill

A detailed guide on how to proceed with your AT&T bill pay

If you have subscribed to any AT&T services, you must pay your monthly bills to keep enjoying your services. However, AT&T's bill pay process is easy, and AT&T provides multiple payment options on its

. Now, you can connect your

bank account or debit card and pay all your AT&T bills quickly.

AT&T offers a variety of services that you may have subsribed to

1.

AT&T Wireless phone bill pay

: Applicable for your mobile phone service, including charges for voice, text, and data usage

2.

AT&T Internet bill pay

: Applicable for your internet services - including all internet packages, equipment rentals

3.

AT&T TV bill pay

: Applicable for your TV service with AT&T. It includes charges for your TV package, any equipment rentals

Note:

1. The availability of the above services may vary depending on your location.

2. If you have a bundled service package with AT&T that includes TV, internet, and phone, you may receive a single bill that includes charges for all these services

A step by step process on how to pay AT&T bill online

To proceed with Bill pay from your Juno account, go to Google Chrome browser and follow these steps (follow similar steps on your AT&T App on your Apple or Android phone):

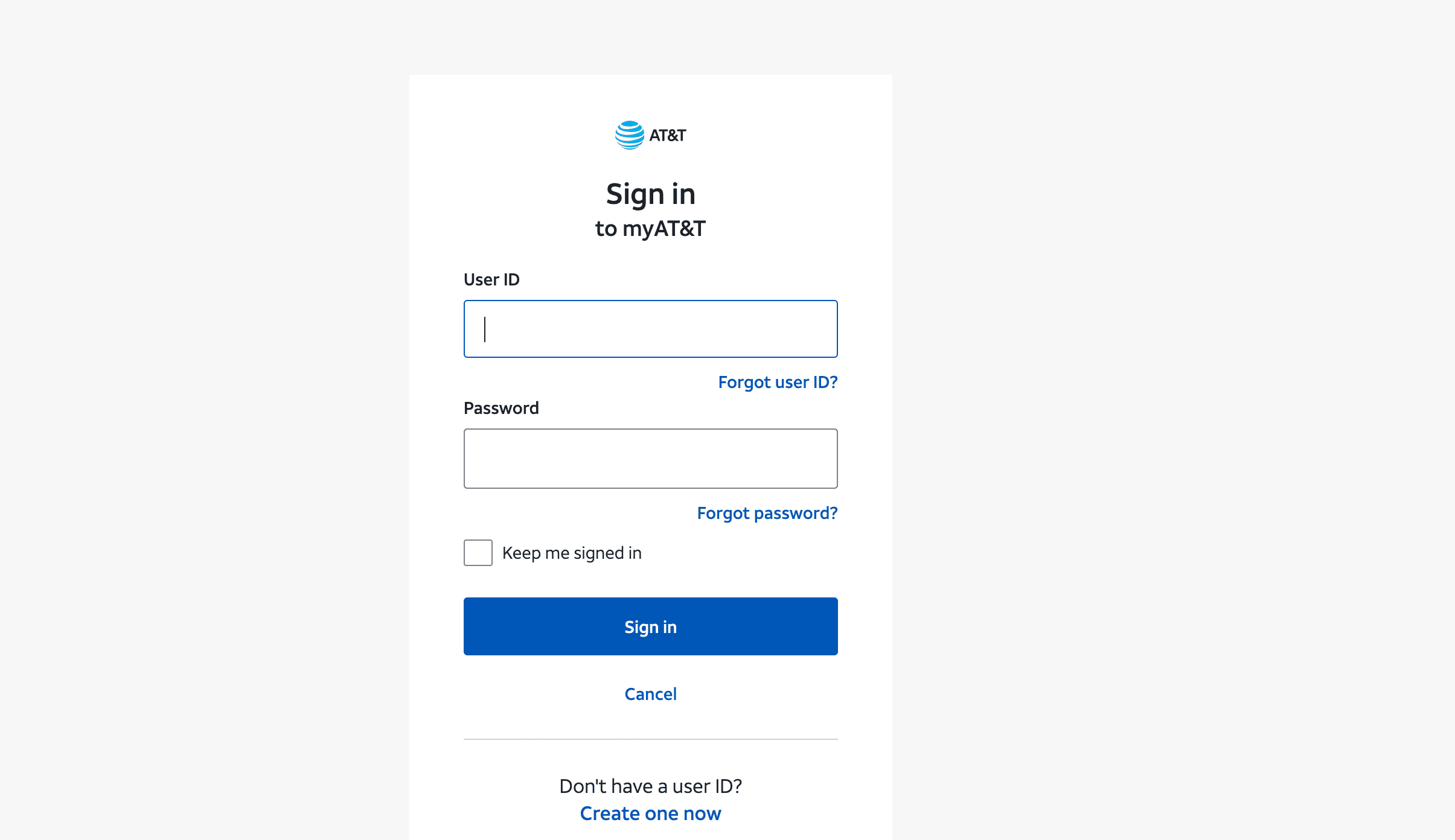

1. On Chrome, enter the website https://www.att.com/ and click "Sign In". Then enter your credentials to sign in.

Image Source - AT&T Official website

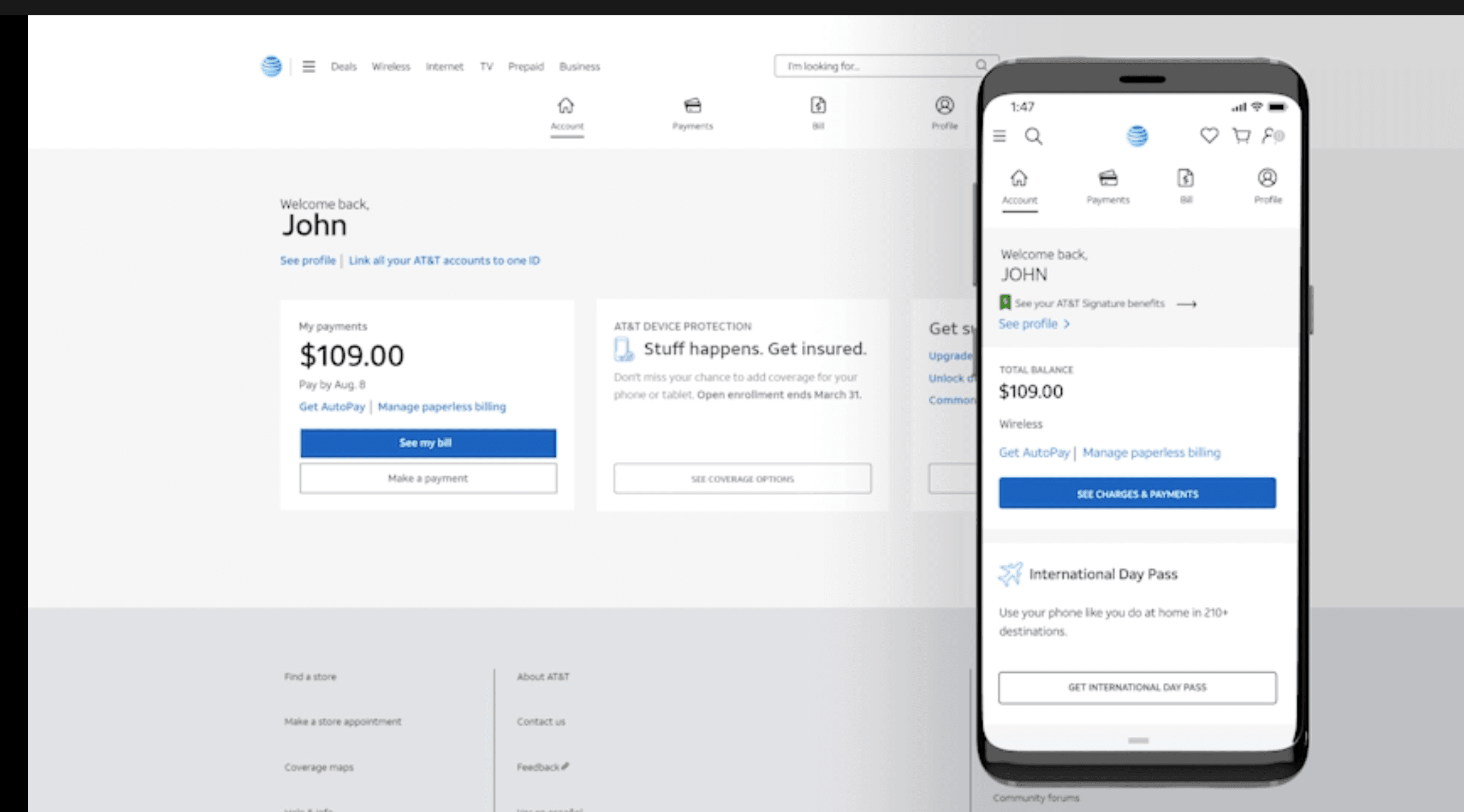

2. Once logged in, locate your bill by clicking the "Billing" tab at the top. Then click the "See my bill" button next to your account balance to view your bill statement.

Click the "Make a payment" button to proceed with the payment.

Image Source - AT&T Official website

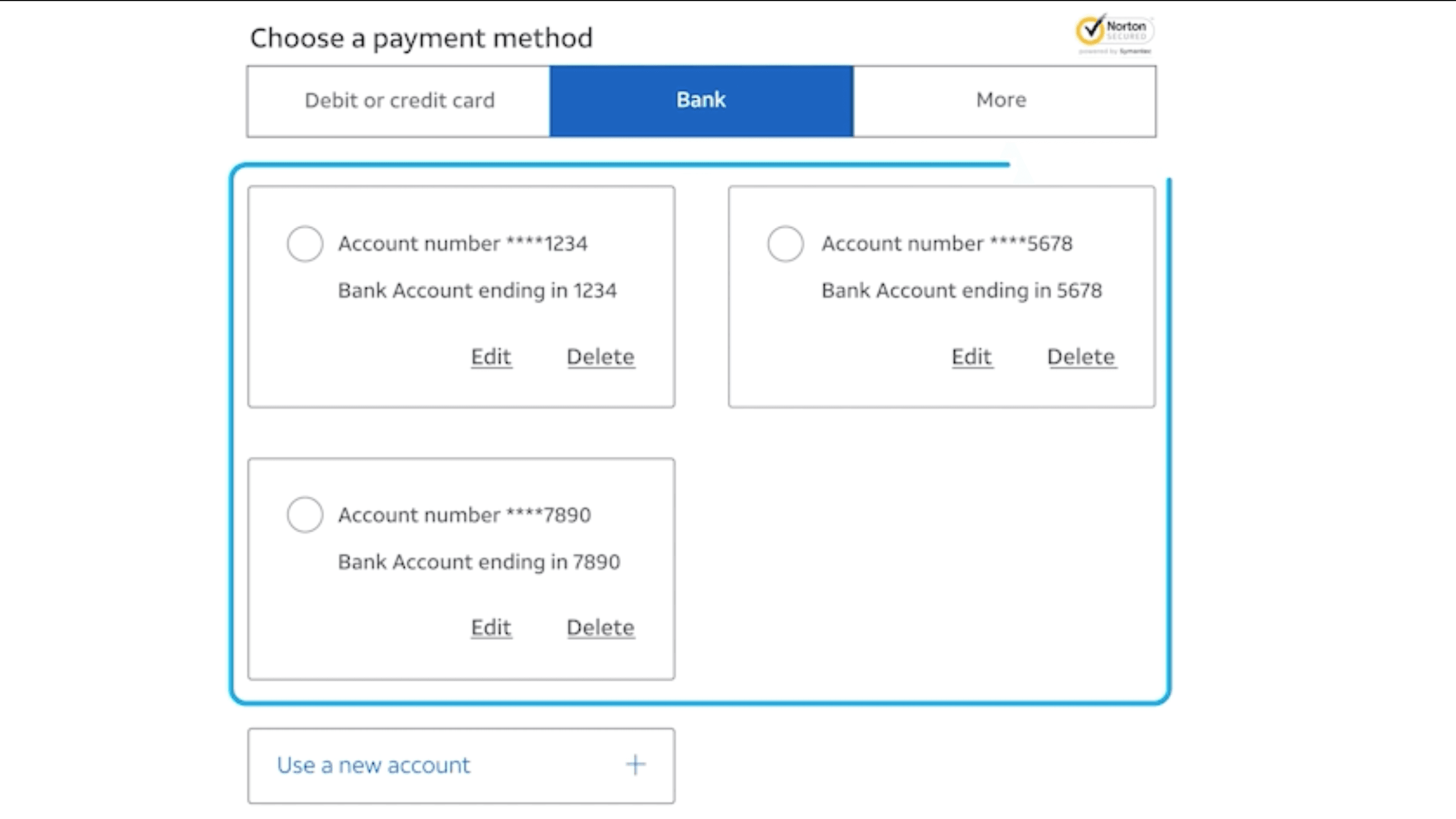

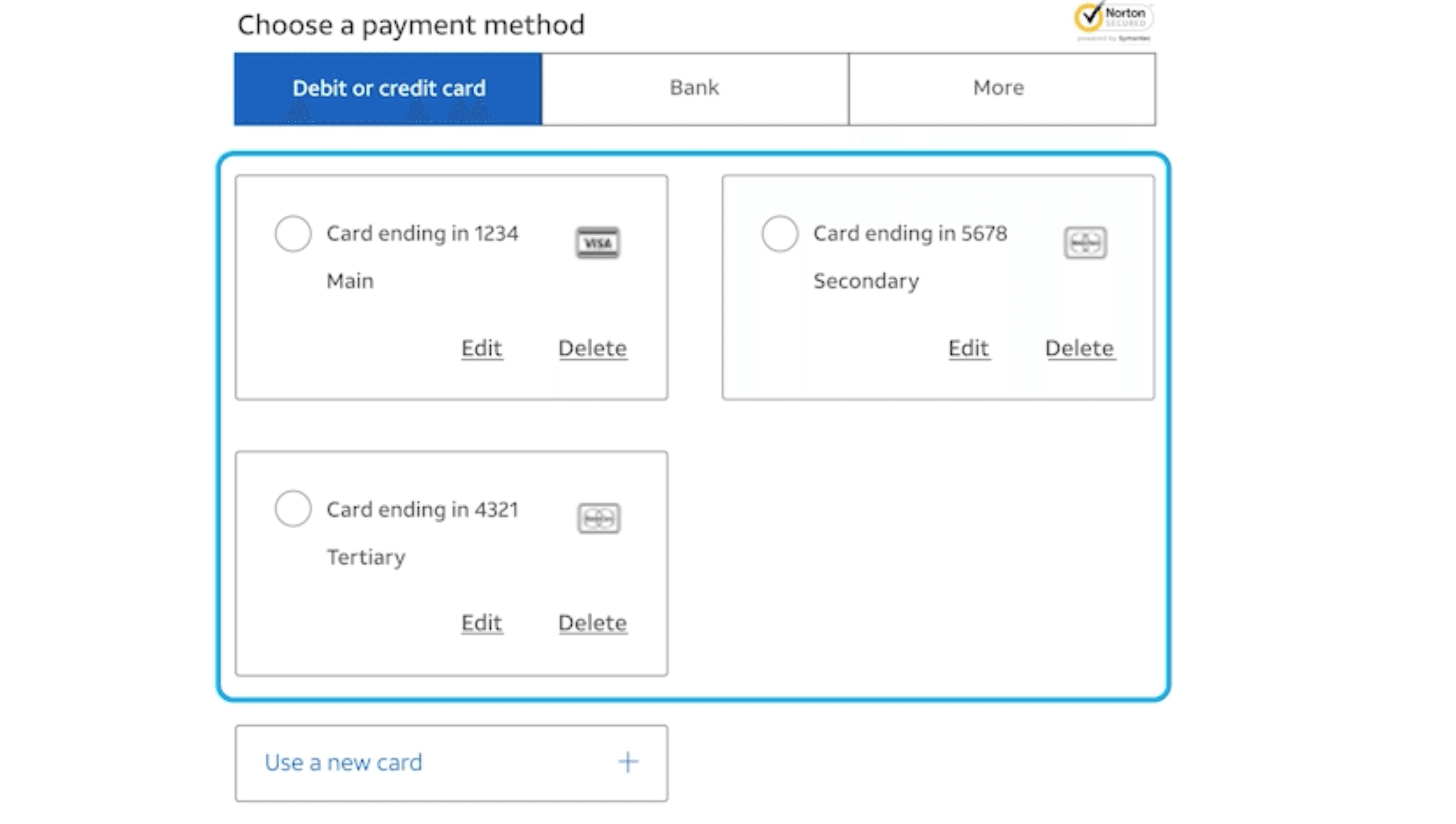

3. Enter your payment information, including the amount, and select the payment method you want to pay with.

While choosing your payment method - Select the ‘Bank’ option to add Juno's bank account details or Select the ‘Debit or Credit card’ option to add Juno's debit card.

Image Source - AT&T Official website

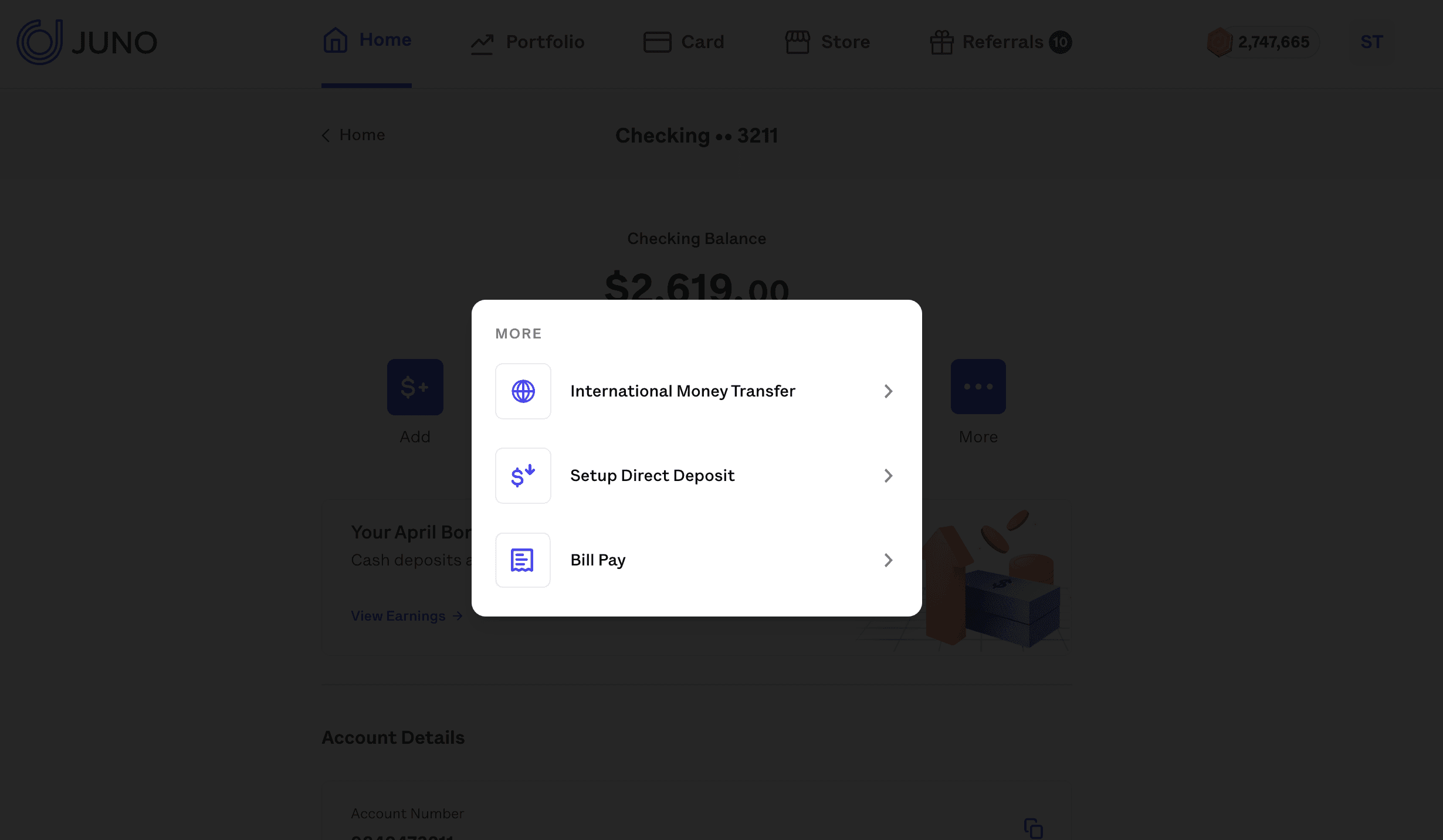

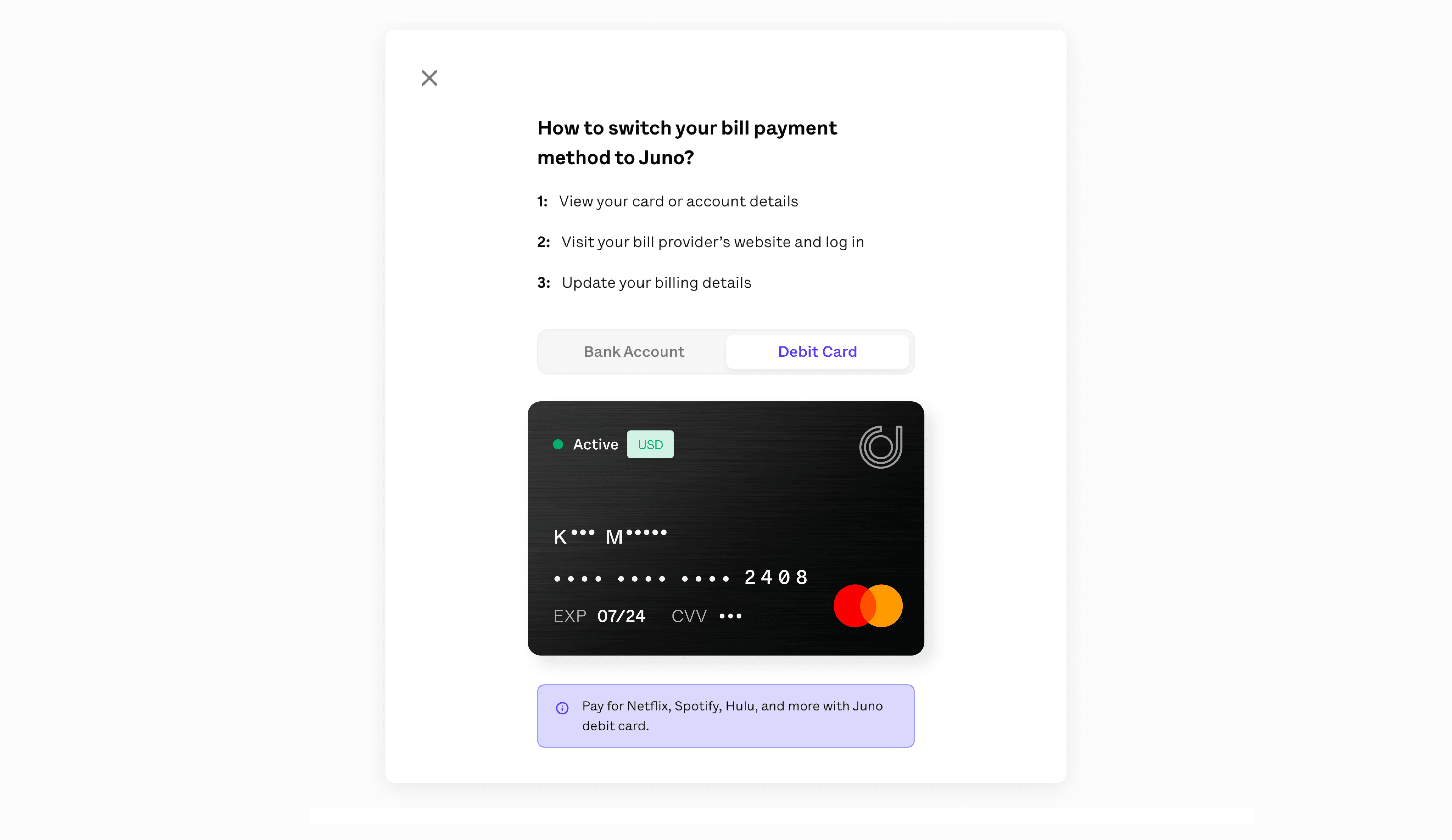

4. Now, go to the Juno app on your phone. On the Home screen, click on “Account” and then click on the 'More' button. Under it, select the "Bill pay" option.

5. Copy the bank account number and ACH routing number to add your account as a payment option.

6. Or Copy the debit card details to add a debit card as a payment option.

7. Go to the AT&T website again, and select "Use a new account.” Add Juno's bank account details, enter your account and ACH routing numbers, and save them.

Image Source - AT&T Official website

8. Alternatively, you can add Juno's debit card details by selecting the “Use a new card” option” and saving it.

Image Source - AT&T Official website

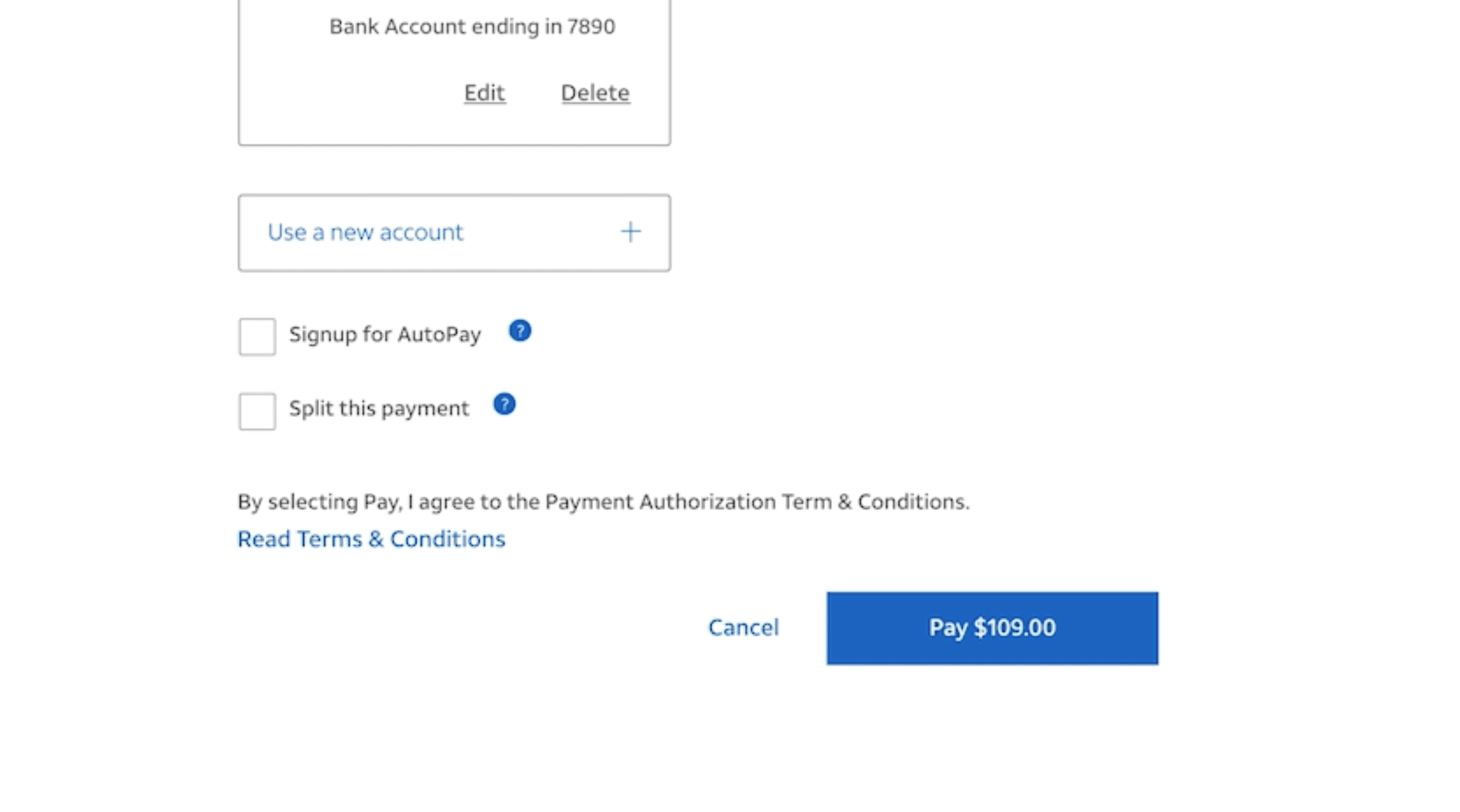

9. Once payment details are entered, click the pay button to proceed.

However, we recommend you select the “Sign up for AutoPay” option for convenience. After every month's end, your payment will be automatically deducted

.

Image Source - AT&T Official website

In addition to paying your AT&T bill online, there are several alternative ways you can make your payment:

1.

Bill Pay by phone

: You can call AT&T customer service at 800.288.2020 or 800.331.0500 and pay over the phone by sharing Juno’s debit card or bank account details.

2.

Bill Pay by mail

: You can mail a check or money order along with the payment stub from your bill to the address listed on your bill.

3.

Bill Pay in person

: You can visit an AT&T store or authorized payment center and pay in person with cash, check, or money order.

Note: Depending on your chosen payment method, additional fees or processing times may be associated with the payment.

QUICK LINKS

Kunal Shivalkar

Kunal is a crypto native marketer and content writer