Personal Finance

•

5 mins read

•

May 27, 2021

What is Gross Monthly Income and How Can You Calculate It?

Learn more about your gross monthly income, why it’s important, and how to calculate it.

When you’re applying for a loan or

, you may be asked about your gross monthly income.

In this quick guide, we’re going to break down what you need to know about gross monthly income, how to calculate it, as well as how it differs from other types of income.

What is Gross Monthly Income?

Your gross monthly income refers to the amount of money you earn each month before anything is taken out. In other words, it’s your total income before any deductions or taxes leave it.

So when

and they tell you the annual salary, that is typically your gross income. Your gross monthly income will be how much you earn each month before anything is taken out or subtracted.How to Calculate Gross Monthly Income

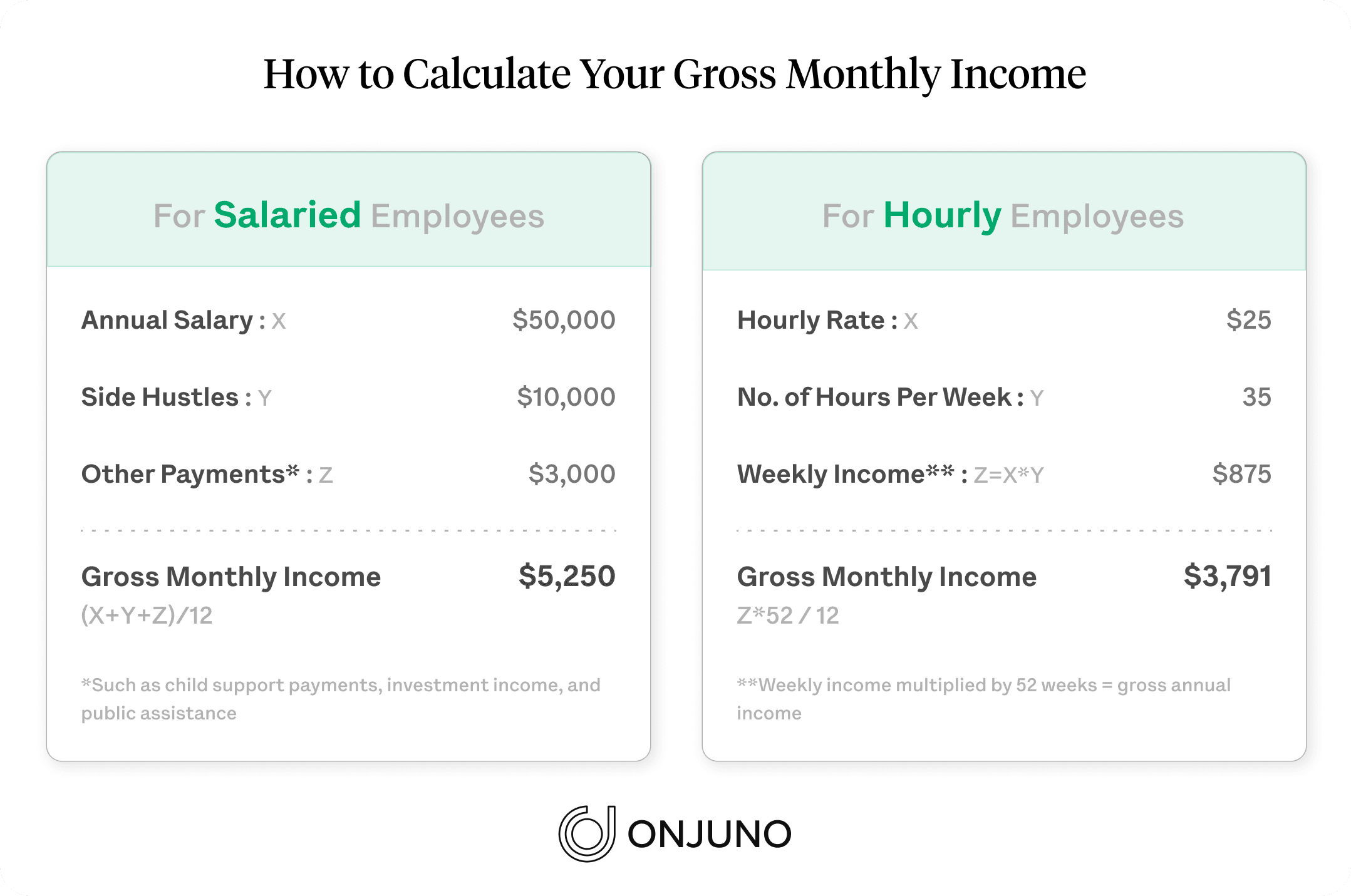

If you’re a salaried employee, it’s easy to calculate your gross monthly income. Simply take your annual salary and divide it by 12, which will give you your gross monthly income.

Let’s say you earn $50,000 each year at your job. That means your gross monthly income would be $4,166. If you earn

, such as freelancing, you may want to include that in your total amount. You may also include child support payments,

, public assistance, and overtime.

This calculation will be helpful when applying for a loan, as it may improve your debt-to-income ratio or make you a more viable candidate.

If you’re an hourly employee, take your hourly rate and multiply it by the hours you work each week. Take that number and multiply it by 52 weeks. That will get you the annual gross income. Take that number and divide it by 12 to get your gross monthly income.

So if you make $25 per hour and work 35 hours per week, you’d make $875 per week. That times 52 weeks in a year equals an annual gross income of $45,500. Dividing that by 12 makes the gross monthly income $3,791.

Difference Between Total Monthly Income, Total Gross Monthly Income, and Total Net Monthly Income

and total gross monthly income are typically used interchangeably. If the word “household” is in front of either of the terms, it means the total income of all the members of the household combined. This is basically taking everyone’s salary and adding it all together to get the total sum.

Knowing your gross monthly income is helpful when applying for financial products. Knowing your net monthly income can also be useful to

and prepare with the money that is actually going into your bank account.

Total monthly income and total gross monthly income differ from your total net monthly income. Your total net monthly income is the total amount after everything is taken out and subtracted. So this is the amount after taxes, deductions, etc. are taken out.

Because of that, your total net monthly income is lower than your total gross monthly income. Sometimes this can be significantly less, depending on the taxes and deductions taken out. If you’ve ever been shocked to see how much money is in your paycheck after thinking you’d make a certain amount after being told your gross monthly income, you know what I mean!

You can typically see your net monthly income on your paycheck after taxes and deductions are taken out. You can also use this

to help you out. Net salary is sometimes referred to as net pay or take-home pay and that is the amount you can actually work with for accurate budgeting.

If you’re curious about what is gross monthly income or how to calculate gross monthly income, we hope our guide has helped you easily get the numbers you’re looking for.

In a nutshell, ‘gross’ is the total amount and ‘net’ is what you take home after everything like taxes and deductions are subtracted. Knowing these numbers can be useful when applying for loans, a mortgage, or a credit card.