Personal Finance

•

2 mins read

•

February 08, 2021

Navy Federal Routing Number

Find your routing number and everything else you need to know to send money in the USA and abroad

Your

Navy Federal Credit Union Routing Number

plays an important role in directing where your money should go. It identifies a particular financial institution and can streamline transactions like direct deposits or making payments. You can easily find your routing number on this page, on your checks or by logging into your online account.

Navy Federal Credit Union Routing Number

Navy Federal Routing Number for Domestic Wire Transfers -

256074974

Navy Federal Routing Number for International Wire Transfers -

256074974

What Is a Routing Number?

A routing number is a 9-digit number that identifies the

related to the bank account.

The nine digits can be broken down into several components. The first four digits of your routing number refer to the Federal Reserve routing number and the following four refer to an American Bankers Association (ABA) routing number, and the last number is the “check digit”. A “check digit” is used to verify the routing number through a special equation. This can help ensure its accuracy and authenticity.

Navy Federal Routing Number for ACH Transfers

If you're looking to complete an ACH Transfer to any Navy Federal Account, use the ACH Routing Number

256074974

.

What Is a Navy Federal Routing Number Used For?

So you might be wondering what the Navy Federal routing number has to do with you and why it’s important, but a routing number is actually used for many different day-to-day financial transactions.

A routing number is used to complete financial transactions such as direct deposit payments, bill payment, and tax payments. Your routing number serves as the location identifier for the financial institution you opened your account with.

So for example, when you have direct deposit, your paycheck is put into your bank account. The routing number in this case tells the money which financial institution to go to.

Routing numbers are kind of like addresses for financial institutions and each one will have a different one. The number illustrates that the financial institution has an account with the Federal Reserve.

Different Types of Routing Numbers

Your routing number is used to identify a particular financial institution. But some big financial institutions can have various routing numbers that may be based on the state you hold the account in.

On top of that, there can be different types of routing numbers based on the specific action. For example, there can be different routing numbers for wire transfers than ACH or direct deposit.

Navy Federal Routing Number vs Account Number

Your Navy Federal routing number isn’t the only important number when it comes to

. Your account number plays an important role as well.

When completing financial transactions, you’re typically asked about your routing number _and_ your account number.

But what’s the difference?

The routing number is the identifier of the bank or financial institution, whereas your account number refers to your specific financial account. So an account number can represent _your_ personal checking account, for example.

So your routing number is kind of like your address and your account number is like an apartment number, showing which specific one it is.

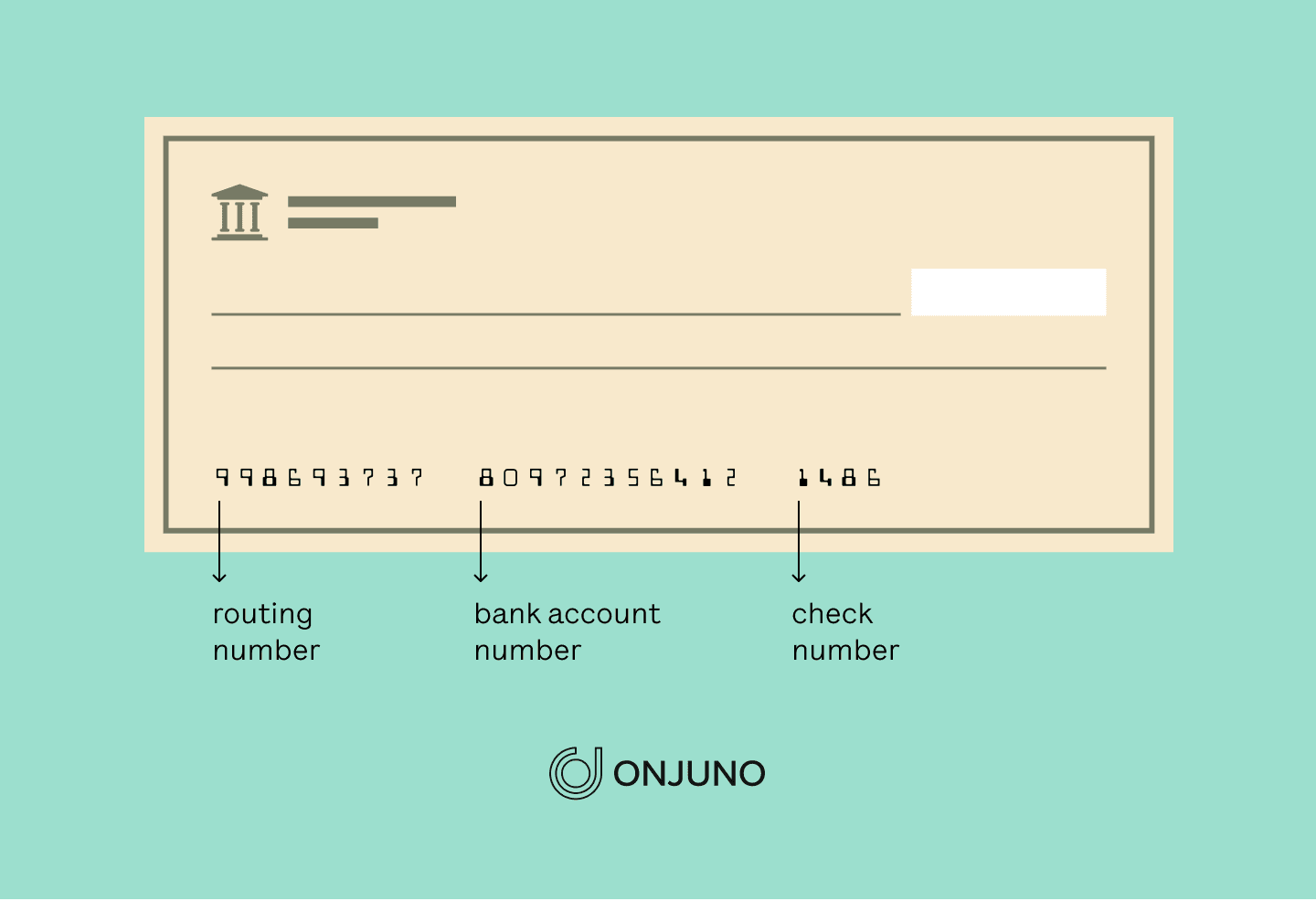

Where to Find the Navy Federal Routing Number on a Check

Though checks are going out of fashion in favor of digital tools for payments, you might still need to use one from time to time. Your checks have your routing number on them. If you need to find your routing number on a check, look at the 9-digit number in the bottom left-hand corner. That is your routing number, but it’s just the nine digits.

The other digits in the middle are your account number and the numbers on the right side are your check number.

Routing Number vs Swift Codes vs IBANs: What's the Difference?

Routing numbers are used for financial transactions in the U.S. to identify the financial institution. But there are also other codes that do something similar but in different places outside of the U.S.

For example, there are SWIFT codes. SWIFT stands for Society for Worldwide Interbank Financial Telecommunication.

SWIFT codes

are used when sending or receiving money from abroad and are similar to a routing number. SWIFT codes identify a particular financial institution.

IBAN, or International Bank Account Number,

refers to a specific country and account, so it’s similar to an account number though not a replacement for one. SWIFT codes and IBANs are used to manage overseas payments, whether you’re sending or receiving.

So you might see the terms ‘routing number’ and ‘account number’ when referring to payments sent and received in the U.S., but you’ll see terms ‘SWIFT codes’ and ‘IBAN’ for international payment transactions.