Newsroom

•

15 mins read

•

May 21, 2024

Latest updates on banking and card services

Despite the massive impact on end users due to the Synapse bankruptcy and Evolve’s actions, regulators have yet to take meaningful steps to accelerate access to end user funds held at Evolve Bank & Trust as per the Synapse Trial Balance Report.

is organising a collective push to lawmakers. You can take action by sending a letter to your representative using the

. Stay informed and support the movement by visiting their site.

Hearing Update – February 7, 2025

On February 7, 2025, a hearing was held to discuss the Chapter 11 Trustee’s

for Synapse Financial Technologies. Juno’s legal representative attended the hearing.

During the hearing, the Chapter 11 Trustee stated that they would explore the possibility of converting the case into a Chapter 7 liquidation if no further value could be generated for the estate.

Additionally, the trustee mentioned that there was no new information provided by the IRS regarding the tax-related questions that have been raised in previous hearings. The trustee also mentioned that despite their previous efforts to coordinate with various regulatory bodies, there has been no indication of regulatory intervention or action to expedite the process.

Juno remains deeply disappointed by the continued lack of resolution and regulatory involvement. We continue to advocate for a swift resolution that prioritizes affected customers and ensures they regain access to their funds as soon as possible. We will provide further updates as new information becomes available.

Juno and Other Fintech Partners Drive Senate Action, Prompting Federal Reserve Response

Juno, in collaboration with other fintech partners, through persistent lobbying efforts, successfully brought these concerns to the attention of the Senate Banking Committee. As a result, Representative John Rose raised critical questions about the stalled resolution process with the Chairman of the Federal Reserve Board, Jerome Powell during a recent hearing.

Chairman Powell acknowledged the seriousness of user complaints and assured that the Federal Reserve is closely monitoring the situation. He further stated that if regulatory breaches are identified, the Federal Reserve will take appropriate action to ensure compliance and protect affected users.

The exchange can be viewed in the Federal Reserve’s Semi-Annual Monetary Policy Report Hearing, where Representative Rose lobbied on behalf of Juno and other fintech partners.

Watch the discussion (Timestamp – 2:16:10):

What happened?

On May 7th, 2024

We were notified that Lineage Bank, Member FDIC, halted ACH processing for all Synapse Brokerage accounts, and that Evolve Bank & Trust, Member FDIC, would now process ACH transactions on behalf of Synapse Brokerage. Juno's end users hold accounts with Synapse Brokerage.

On May 11th, 2024

We were notified by Evolve Bank & Trust that they would be immediately halting card payments. They also stopped processing any incoming ACHs and Wires. Please note that both end user account and routing numbers as well as the debit card is issued by Evolve Bank & Trust. These events have left Synapse Brokerage without an ACH processor, and Evolve Bank & Trust’s decision to freeze cards and incoming ACHs and Wires is causing transactions to fail.

On May 13th, 2024

We learned in court proceedings that Evolve Bank & Trust had taken this action because they were unable to access a key dashboard provided by Synapse which according to Evolve Bank & Trust was necessary to perform their duties as a regulated financial institution. Again, we have no control over these actions by Synapse or Evolve Bank & Trust and we learned about this only after Evolve Bank & Trust had already frozen accounts and restricted access to end user funds.

On May 25, 2024

A hearing took place on May 24, 2024, in the US federal court regarding the ongoing dispute between Evolve and Synapse. While the dispute remains unresolved, significant progress was made during the hearing. Jelena McWilliams, the former Chairman of the Federal Deposit Insurance Corporation (FDIC), was appointed as the Chapter 11 Trustee for Synapse. The court instructed Trustee McWilliams to prioritize ensuring end users have access to their funds. Additionally, the court mandated regular weekly updates from the US trustee on the progress being made.

On June 8, 2024

The new Chapter 11 Trustee, Jelena McWilliams, presented her initial report to the US Federal court. Her report detailed out the timeline of events and her interactions with all the relevant stakeholders including partner banks, fintech platforms, regulatory authorities and end users. Her appointment has instilled confidence among fintechs and end users for a swift resolution. Her commitment was highlighted further when she requested a call with the Juno team over the Memorial Day weekend immediately after her appointment. Juno has offered resources at our disposal to help the trustee expedite the process of end user withdrawals.

The trustee has been instructed by the court to prioritize getting users access to their funds as the top priority. In that spirit, the trustee has presented some immediate steps forward while all the Partner Banks continue their reconciliation process, which according to the trustee could take several weeks. From all the options she presented in the hearing, her recommendation is that Partner Banks should release pro rata amounts of end user funds immediately and the remaining balances will not be paid out while reconciliation efforts continue.

The exact process and pro rata amounts eligible for withdrawals are still not known at this time and we await instructions from the trustee for the next steps. As soon as we get instructions from the trustee, our team is ready to execute on the next steps and ensure end users get access to their funds. We will keep you informed about the next steps and any actions you may need to take.

In the hearing, Juno's counsel highlighted that Juno platform's end users continue to remain affected and are still unable to access funds for 4 weeks now. Our counsel also appreciated the progress being made and the urgency shown by the trustee to get users access to their funds. Our counsel also agreed with the trustee's recommendation to provide interim relief to the end users by releasing pro rata amounts immediately while final reconciliation continues. This provides end users access to funds in the most equitable manner.

On June 18, 2024

Synapse Chapter 11 Trustee, Jelena McWilliams, presented the second status report to the US Federal court in the Synapse bankruptcy hearing held on June 14, 2024. The report talks about the ongoing reconciliation between Synapse’s partner banks and her focus on ensuring end users have access to their funds as soon as possible.

The Trustee’s earlier recommendation was to provide interim relief to end users by releasing pro rata amounts immediately while final reconciliation continued. In the latest report, the Trustee highlighted that on June 11, 2024, she communicated to the Partner Banks that she does not have authority to direct the Partner Banks’ distribution of end user funds. She mentioned that the Partner Banks should proceed with regards to the end user funds as they deem appropriate and on advice of their respective legal counsel.

The Trustee also shared that she has notified regulators which regulate Synapse’s partner banks which include Federal Deposit Insurance Corporation (FDIC), Federal Reserve Board (FRB) and Office of the Comptroller of the Currency (OCC). She offered to work closely with these regulatory agencies while also requesting these agencies to provide regular updates on their website about the ongoing work they are doing with Synapse’s partner banks.

During the hearing, the Trustee estimated that most achievable efforts with regards to reconciliation may be completed in the next two weeks. Juno continues to work with the Trustee and we have offered all the resources at our disposal in ensuring swift resolution and helping end users get access to their funds.

We are awaiting instructions from the Trustee or Synapse’s partner banks as to the exact placement of end user funds and the process for disbursal of end user funds. As and when we have confirmation from the Trustee or Synapse’s partner banks we will promptly share that information with customers.

On June 20, 2024

Thank you for your patience as we continued to respond to the issues with our previous banking-as-a-service provider ecosystem and the systemic problems that have come to light in the industry generally. We are pleased to share that we’ve found a new banking partner in

to help power the next chapter of Juno into the future, built on the principles of

.

Our teams have been heads-down and hard at work together, and the integration with Jiko is now complete.

What it means for you

We’re pleased to begin the rollout and welcome you to the next chapter of Juno.

- Once you have access, you can simply create a Juno Treasury Account, powered by Jiko. Simply log in to Juno and apply*. We’ve made it easy to do so right from the Juno app or website.

- From there, you will be able to continue leveraging Juno to get on-chain, and to access essential financial services like bill payments, paychecks, and crypto on- and off-ramps.

What is Jiko?

Jiko is a vertically integrated financial institution, headquartered in San Francisco, that combines its nationally chartered bank and registered broker-dealer to hold your cash in Treasury bills – all in safe custody. Jiko is built from the ground up on principles of

,

and our companies will be jointly communicating more in the coming weeks.

What about my previous Cash Account?

Your previous Cash Account, provided by Synapse Brokerage LLC and Evolve Bank & Trust, will still be visible on the Juno website and app. We are actively working with the Chapter 11 Trustee to get customers access to the funds in the previous Cash Account as soon as possible.

Creating a new Treasury Account, powered by Jiko, is not a requirement for and won't impact the ongoing process of getting access to the funds in your previous Cash Account.

For more detailed questions and answers, please see our

, and don’t hesitate to reach out to [email protected].

On June 24, 2024

Synapse's Chapter 11 trustee presented her third weekly status report to the U.S. federal court on June 21, 2024 detailing the ongoing efforts and progress in ensuring end users get access to their funds. The detailed report is available

.

As per the status report, one of Synapse's partner banks, AMG National Trust, has begun disbursing funds to end users. We are actively collaborating with AMG National Trust to establish exact procedures for distributing funds to Juno platform's end users based on AMG National Trust's reconciliation process. We will promptly notify you once these procedures are finalised.

During the latest hearing, Juno's legal counsel emphasised the urgency of the situation, noting that end users have been unable to access their funds for over five weeks, which is extremely concerning. Juno had agreed with the trustee's recommendation for pro-rata distribution (Option 3), but since the trustee concluded that Synapse's partner banks must make their own distribution choices, Juno has proactively reached out to Evolve Bank & Trust and AMG National Trust.

Furthermore, since Evolve Bank & Trust and Lineage had advocated for pro rata disbursals while their reconciliation efforts continued, we are awaiting instructions from these banks to facilitate pro rata withdrawals but neither of them have given us the next steps so far.

The Chapter 11 trustee highlighted during the hearing that she has written a letter to regulators of the FRB, OCC, FDIC, requesting agency resources to assist end users and depositors understand which Partner Bank holds their funds and facilitating end users’ interaction and communication with relevant Partner Banks and, in the case of the SEC and FINRA, to help field end user inquiries with Synapse Brokerage.

The trustee continues to facilitate partner banks' additional efforts regarding reconciliation and settlement payments. As there are no significant updates expected next week, the trustee has requested an additional two weeks for her next update. We appreciate your patience and will keep you informed of any developments.

On June 27, 2024

We recently learned of a cybersecurity breach affecting one of Synapse's partner banks, Evolve Bank & Trust. This breach resulted in unauthorized access to and leakage of records, such as account numbers and other personal information related to their fintech programs.

We promptly contacted Evolve Bank & Trust to obtain more information about the breach, its potential effects on Juno platform's end users, and the remediation steps they are taking. Evolve Bank & Trust has acknowledged these claims of a cyber incident and is investigating the situation. Evolve Bank & Trust further mentioned that they will provide detailed communication to share with end users. We will update you as soon as we have more information from them.

Please note that your Juno account password was not exposed as we do not share this information. For more details, please visit the Evolve Bank & Trust

page.

To learn more about trust and safety at our new banking partner, Jiko, please visit

.

On July 8, 2024

Synapse's Chapter 11 trustee filed a

alongside a

. A hearing was held to discuss these reports. To aid reconciliation efforts, the trustee is working to provide Synapse's Partner Banks with confidential, read-only access to all relevant Synapse data (ledger records, systems). The Trustee has appointed B. Riley Financial Inc. to assist with forensic accounting and manage Synapse’s assets.

Juno's legal counsel actively represented our users' concerns and highlighted the recent cybersecurity breach at Evolve Bank & Trust during the hearing. In light of this situation, Juno's legal counsel called for a swift resolution to promptly restore end users' access to their funds and Evolve Bank & Trust's responsibility to promptly and directly notify end users who were affected by this hack.

The trustee also directed the users to reach out to the government agencies for complaints or inquiries regarding the ongoing situation:

FRB which is the regulator for Evolve Bank & Trust: Consumers who are experiencing issues with accessing funds can file complaints through the Federal Reserve Consumer Help (FRCH)

by utilizing the online form; by fax (1-877-888-2520); or by mail (P.O. Box 1200, Minneapolis, MN 55480). A consumer may also contact FRCH directly at

if they need assistance or have questions about filing a complaint.

OCC which is the regulator for AMG National Trust: A customer may call the OCC Customer Assistance Group (Monday - Friday: 7am - 7pm CT) at

. Customers of OCC-supervised institutions, who are experiencing problems accessing their their funds can also file a complaint using, among other options, an online complaint form available at

FDIC which is the regulator for Lineage Bank: Consumers can find more information on how to contact the FDIC at

, or can call 877-ASK-FDIC.

On July 22, 2024

On July 17th 2024, Synapse’s Chapter 11 trustee filed the

and a hearing was held to discuss this report. The trustee informed that she and her advisors continue to make progress on the reconciliation efforts on making all synapse ledger, data and records available to Synapse's partner banks and that substantial work remains to be done here.

Evolve Bank & Trust in its statement attached as a part the trustee’s report stated that they are proceeding with a plan to calculate the actual current balance for Synapse Brokerage end users across the Synapse ecosystem, independent of the ledgers generated by Synapse. They expect this effort to take approximately two months post the collection of the complete data.

In the hearing, Juno’s lawyer expressed concerns on behalf of Juno platform's end users, stating that a two-month period for Evolve Bank & Trust to reconcile end users balance would result in huge inconvenience for end users. Juno's lawyer requested Synapse's partner banks to expedite the process of reconciliation and begin disbursals as soon as possible and that Juno will promptly work with Synapse's partner banks to provide payment information of end users in case their records indicate that they hold end user funds for any specific user.

Juno’s lawyers further voiced concerns that, to Juno’s knowledge, there had been no communication from Evolve to the end users affected by the Evolve data breach, despite Evolve's promise to do so from July 8th 2024 onwards.

On August 6, 2024

On August 1st 2024, Synapse’s Chapter 11 Trustee filed the

and a hearing was held to discuss the findings of this report. The Trustee had previously highlighted in June 2024 that Synapse's Partner Banks should proceed with the distribution of end user funds as they deem appropriate and on advice of their respective legal counsel. Since then Juno had reached out to Synapse's Partner Banks to understand their plans for distributing funds to end users.

The only information made available to Juno to date with respect to end user balances was shared by Synapse via the trial balance report. AMG claims to have successfully reconciled the balances they hold for end users based on the Synapse Trial Balance Report. Whereas Lineage Bank and Evolve Bank & Trust have observed some issues in Synapse Trial Balance Report due to which they will be proceeding with their own reconciliation process to determine the balances they hold for each user and will subsequently determine the procedure for disbursal of end user funds.

Since Juno does not or has never held end user funds, the exact placement of end user funds can only be reconciled and confirmed by Synapse's partner banks. Juno has no involvement in this ongoing reconciliation process conducted by Synapse's partner banks. Juno's role is only to collect and provide necessary payment information of end users to help Synapse's Partner Banks make disbursals.

Juno has now finalized exact procedures with AMG National Trust for them to distribute funds they hold for Juno platform's end users based on AMG's reconciliation process. Juno is collaborating with AMG to provide them the necessary user information and details to help them make disbursals directly to end users.

Lineage Bank, in its statement attached to the Trustee’s sixth status report, stated that they have made significant progress in their reconciliation efforts. They estimate that they will be able to begin distributing funds to end users before the end of August. Juno has reached out to Lineage Bank to establish exact procedures with Lineage bank to help them distribute funds they may hold for Juno Platform's end users.

Evolve Bank & Trust, in their statement attached to the trustee's sixth status report, announced that they are currently reconciling end user balances and have engaged with Ankura Consulting Group, a third-party firm with strong expertise in accounting and reconciliation, to assist in these efforts. As per Evolve's update in the previous status report, they had mentioned that the reconciliation efforts could take two months post the collection of the complete data from Synapse. Although Evolve did not mention any timeline in their latest update, they indicated in the hearing held on Aug 1 that it would take approximately one week for them to procure the complete data set from Synapse.

Juno will begin collecting bank account details from all end users to help them receive their funds as soon as it is available for disbursal from Synapse’s partner banks. Please note that providing your details doesn't guarantee that your funds will be disbursed from Synapse’s partner banks. This is just a proactive measure from Juno. We will keep you informed about the next steps and any actions you may need to take.

On August 21, 2024

Synapse’s Chapter 11 Trustee filed the

and a hearing was held on August 15th 2024, to discuss the findings of this report. The report and the hearing outlined that the partner banks are proceeding with the reconciliation of end user funds. Evolve Bank and Trust and Lineage Bank have added their own reports with additional information on their reconciliation effort.

Since Juno does not or has never held end user funds, the exact placement of end user funds can only be reconciled and confirmed by Synapse’s partner banks. Juno has no involvement in this ongoing reconciliation process conducted by Synapse’s partner banks. Juno’s role is only to collect and provide necessary payment information of end users to help Synapse’s Partner Banks make disbursals.

Following our previous update, Juno has started and continues to collect bank account details from all end users to help them receive their funds as soon as it is available for disbursal from Synapse’s partner banks. Please note that providing your details doesn’t guarantee that your funds will be disbursed from Synapse’s partner banks. This is just a proactive measure from Juno. We will keep you informed about the next steps and any actions you may need to take.

Disbursements for users whose funds are at AMG National Trust are now underway. Juno is actively working with AMG, providing the necessary user information and details collected from end users to facilitate direct disbursements from AMG to the users.

In the trustee’s sixth status report, Evolve Bank & Trust had informed that they had engaged Ankura Consulting Group to assist with reconciliation efforts. In the seventh status report, Ankura Consulting Group provided an update alongside Evolve’s, indicating that data collection from the Synapse database—an essential step in end-user reconciliation—is almost nearing completion. The anticipated timeline for completion of the reconciliation according to Evolve still remains 8 weeks as mentioned in the previous report. Evolve has been providing updates to their reconciliation process on their website

as well.

Lineage Bank in its report had mentioned that it continues to make progress in reconciliation of end user balance and that substantial work remains to be done. They remain optimistic to achieve their target of starting end user disbursals by the end of August.

We've heard concerns from users during the Synapse bankruptcy hearing about potential phishing attempts related to the disbursement process. To prevent confusion and enhance security, Juno is proactively collecting payment information through our official platform. Safeguard your account by connecting your destination bank account for disbursal exclusively via Juno's website or app. Always verify that communications you receive are from legitimate Juno email addresses, and never share your credentials with anyone claiming to assist with withdrawing locked funds from Synapse's partner banks. Stay vigilant and report any suspicious activity to our support team.

On September 9, 2024

The Chapter 11 Trustee for Synapse filed the

, which was followed by a hearing on August 30th, 2024, to discuss its findings. Both the report and the hearing provided an overview of the progress made by Partner Banks in disbursing end-user funds. Additionally, the Partner Banks voluntarily submitted updates on their reconciliation efforts, which were included as attachments to the report and were also discussed during the hearing.

Since Juno does not or has never held end user funds, the exact placement of end user funds can only be reconciled and confirmed by Synapse’s Partner Banks. Juno has no involvement in the ongoing reconciliation process conducted by Synapse’s Partner Banks. Juno’s role is only to collect and provide necessary payment information of end users to help Synapse’s Partner Banks make disbursals.

AMG National Trust Bank, in a report attached to the trustee’s filing, confirmed that it has disbursed 99% of the Synapse-related end user funds it held.

Juno is actively collaborating with AMG by providing the necessary user information and details collected from end users to facilitate AMG’s direct disbursement of end user funds. The disbursement process for Juno users whose funds are held at AMG National Trust has been underway since August 13, 2024. Juno has already helped AMG disburse over 90% of the funds AMG claims it holds for Juno platform’s end users. We are actively working on helping them disburse the rest of the funds AMG holds for Juno platform’s end users.

In its update, Lineage Bank reported that it has begun distributing approximately $49 million to affected Synapse-related end users, with plans to continue additional distributions in the coming weeks. Juno has reached out to Lineage Bank to confirm whether any of its end users are included in these distributions, but we have yet to receive a response.

Evolve Bank & Trust, in their statement attached to the trustee’s report, reported that the data collection required for the reconciliation process was substantially complete as of August 23, 2024. They also confirmed that the timeline for completing the overall reconciliation process remains at eight weeks from the date of data collection.

On September 18, 2024

The Chapter 11 Trustee for Synapse filed the

, which was followed by a hearing on September 13th, 2024, to discuss its findings. Both the report and the hearing provided an overview of the progress made by Partner Banks in disbursing end-user funds. Additionally, Evolve Bank and Trust and Lineage Bank have voluntarily submitted updates on their reconciliation efforts, which were included as attachments to the report and were also discussed during the hearing.

Since Juno does not or has never held end user funds, the exact placement of end user funds can only be reconciled and confirmed by Synapse’s Partner Banks. Juno has no involvement in the ongoing reconciliation process conducted by Synapse’s Partner Banks. Juno’s role is only to collect and provide necessary payment information of end users to help Synapse’s Partner Banks make disbursals.

The trustee’s report mentioned that, AMG has paid out $109,448,277 (99% of total FBO funds held by AMG) for the benefit of over 90,000 end users as of September 12, 2024. Juno is actively collaborating with AMG by providing the necessary user information and details collected from end users to facilitate AMG’s direct disbursement of end user funds. The disbursement process for Juno users whose funds are held at AMG National Trust has been underway since August 13, 2024. As of 19th September, Juno has already helped AMG disburse over 93% of the funds AMG claims it holds for Juno platform’s end users. We are actively working on helping them disburse the rest of the funds AMG holds for Juno platform’s end users.

In its update, Lineage Bank reported that it has completed distributing approximately $55 million, roughly 90% of end users funds it held to affected Synapse-related end users, and plans to continue additional distributions in the coming weeks. Juno has reached out to Lineage Bank to confirm whether any of its end users are included in these distributions, but we have yet to receive a response.

Evolve Bank & Trust, in their statement attached to the trustee’s report, reported that Ankura Consulting Group, a third party firm leading the reconciliation efforts on the bank’s behalf, is currently analyzing the contents of the Synapse databases and Evolve’s records to reconcile account-by-account, transaction-by-transaction activity with reported account balances over time. As of the previous report, Evolve mentioned that data collection required for the reconciliation process was substantially complete as of August 23, 2024. Consistent with the previous update, Evolve in its statement attached to the trustee’s ninth status report, reported that they expect the reconciliation to be completed by October 18, 2024.

On September 24, 2024

Lineage Bank responded to Juno's inquiry, confirming that they do not hold any funds belonging to Juno platform's end users. Furthermore, Lineage Bank highlighted that this is consistent with the Synapse trial balance report provided to Lineage Bank by Synapse.

On October 3, 2024

The Chapter 11 Trustee for Synapse submitted the

, followed by a hearing on September 27, 2024, to review its findings.

Since Juno does not or has never held end user funds, the exact placement of end user funds can only be reconciled and confirmed by Synapse’s Partner Banks. Juno has no involvement in the ongoing reconciliation process conducted by Synapse’s Partner Banks. Juno’s role is only to collect and provide necessary payment information of end users to help Synapse’s Partner Banks make disbursals.

The disbursement process for Juno users whose funds are held at AMG National Trust are underway. As of September 26 2024, Juno has already helped AMG disburse over 90% of the funds AMG claims it holds for Juno platform’s end users. We are actively working on helping them disburse the rest of the funds AMG holds for Juno platform’s end users.

In its recent update, Evolve Bank & Trust confirmed that it is on track to complete the reconciliation process by October 18, 2024.

A follow-up hearing is scheduled for October 23, 2024, following the anticipated completion of the reconciliation by Evolve Bank & Trust.

On October 21, 2024

Evolve Bank & Trust has released an important update on its website regarding the reconciliation process, which was expected to be completed by October 18, 2024.

According to Evolve's update, they are preparing to return funds held at Evolve to Synapse Brokerage end users. Additionally, they mentioned that on October 23, 2024, Evolve will launch a resource center at

to provide more information on the reconciliation and the anticipated timeline.

Evolve also mentioned that, to facilitate this return, they have engaged Rust Consulting to oversee the disbursement. As per Evolve's statement, end users will receive an email with additional details, and those with a balance at Evolve will be asked to select a payment method on November 4, 2024, with payments beginning shortly thereafter.

We will share further updates on this as soon as we have more information.

On October 25, 2024

Following its initial update on the reconciliation process, Evolve Bank & Trust has posted an additional update on its website. This includes a FAQ section and a section titled “A Message from Evolve”, featuring video messages from Scott Lenoir, CEO of Evolve Bancorp. Juno encourages impacted end users to review these updates carefully. Evolve has also submitted an attachment as part of the Trustee’s Eleventh Status Report. This latest update follows their previous communication on October 19, 2024, announcing the launch of a resource center at

to provide more information about the reconciliation process and the anticipated timeline for returning funds held at Evolve to Synapse Brokerage end users.

Additionally, Evolve has announced the launch of a dedicated call center to assist with any questions regarding the distribution process. End users can reach the call center at

from 8 a.m. to 5 p.m. CT, Monday through Friday (excluding major holidays).

On Evolve's website, in the section titled "Distribution Process and Payment of End User Balances," Evolve has outlined the following information:

“

On November 4, 2024, Rust will send an email to end users who have a balance at Evolve, directing them to

. End users will login with information provided in that email. Once logged in and authenticated, end users will be provided with their Synapse ecosystem balance as well as the amount of any of their funds that Evolve holds and will be disbursing to them.

Funds will be disbursed in two ways:

Those with balances at Evolve of $100 or more will receive an email with instructions on selecting a payment method to receive their balance. The email will contain an important claim and access code to create an account to register for payment. They will also be given a set of payment methods from which to choose, which may include ACH transfer, wire, or check, among others. Payments will be sent within approximately 7 days of end users setting up their account and choosing their payment method. End users that do not respond by December 4, 2024, will receive a check.

Those with balances at Evolve of less than $100 will receive payments directly through an online payment service. End users that do not claim their payment by December 4, 2024, will receive a check.

Any end user with a balance at Evolve who wishes to receive their balance via check will be able to request one.

If you do not receive an email by November 14, 2024, and believe you are owed a balance by Evolve, please visit

for more information.

”

During the hearing on October 23, 2024, Evolve’s legal counsel stated that in case users wish to dispute the Synapse ecosystem balance displayed on Evolve’s website, they could do so by contacting Evolve’s dedicated call center.

Juno has access only to the information publicly available to everyone on their website and the proceedings in the bankruptcy court. Evolve has not involved Juno in the reconciliation or the future distribution process. Hence, Juno does not have any clarity on whether a shortfall exists or its extent. If you want further clarification regarding this, we encourage you to reach out to Evolve directly using the contact details they’ve provided on their website above.

Disclaimer:

Always verify that communications you receive come from legitimate Evolve email addresses, and never share your credentials with anyone claiming to assist with withdrawing locked funds from Synapse’s partner banks.

On November 4, 2024

As of today, November 4, 2024, some users have reported receiving an email from Evolve Bank & Trust regarding their balances. This email directs users to log in to

to view their Synapse ecosystem balance and the amounts of any funds that Evolve is holding for disbursement.

Please watch for an email from

, and be mindful of phishing scams. To ensure security, we recommend not clicking on any links in emails; instead, go directly to

and enter your Claimant ID number along with the last four digits of your SSN. Once logged in, you will see both an "Evolve Payment" amount and a "Synapse Ecosystem Balance" amount.

If you believe that "Evolve Payment" amount or "Synapse Ecosystem Balance" amount is inaccurate, you may reach out directly to Evolve for clarification. You can file an appeal with Evolve here:

Evolve has set up a dedicated resource center at

to assist with inquiries about the reconciliation and distribution process. Additionally, you can contact Evolve’s call center at

from 8 a.m. to 5 p.m. CT, Monday through Friday (excluding major holidays).

As the trustee had suggested in her earlier reports, if you have concerns regarding Evolve's reconciliation process, you may contact Federal Reserve Bank (FRB), through the Federal Reserve Consumer Help (FRCH) website using the

. For further assistance assistance, you can contact FRCH directly at

.

Post disruptions, the only information made available to Juno to date with respect to end user balances was shared by Synapse via the trial balance report. Evolve claims that these balances mentioned in Synapse trial balance report were “materially inaccurate”, and carried out their own reconciliation of end user balances. This is the subject of ongoing dispute between Evolve and Synapse in which fintechs like Juno have no visibility. Our role has been restricted to providing updates to end users and in some cases helping Synapse’s partner banks like AMG with the disbursement process.

Please note that Juno does not or has never held any end user funds. To our knowledge, Evolve has not involved fintechs including Juno in the reconciliation or the disbursement process. Juno has access solely to the information that is publicly available on Evolve's website and in the bankruptcy court proceedings.

On November 13th at 1 p.m. ET, there will be a public court hearing regarding the reconciliation and distribution process, which is open to all. We encourage impacted end users to attend and share any questions or concerns directly with Evolve and other involved parties.

If you plan to attend, please register in advance, as the admission process may take some time. Detailed information on accessing the hearing is provided below.

Zoom Video Conference link:

Meeting Number:

Password: 495681

Telephone conference lines:

or

On November 13, 2024

In the recent hearing on November 13, 2024, the Chapter 11 Trustee for Synapse submitted the

. Juno’s legal team attended the hearing and highlighted critical points, reflecting our ongoing commitment to our End Users amidst this complex situation.

In the hearing, Juno expressed deep disappointment with Evolve’s reconciliation process, which has yet to fully resolve the access to funds issue for End Users. For Juno, ensuring our users have access to their funds remains a top priority.

Juno attended the hearing to push for clarity and stand firmly with our users. Although Juno is also significantly impacted by this situation, our primary concerns are with our End Users, who urgently need resolutions. During the hearing, we raised the following questions to Evolve which were met with mostly non-answers:

1. Total Fund Disbursement Amount:

We asked Evolve for the final dollar value of funds that would be disbursed to End Users in total now that reconciliation is complete. Despite our emphasis that this fundamental information is readily available to users at an individual level and should have been disclosed without hesitation, Evolve’s lawyer refused to provide a direct response.

2. Reserve Account Discrepancies:

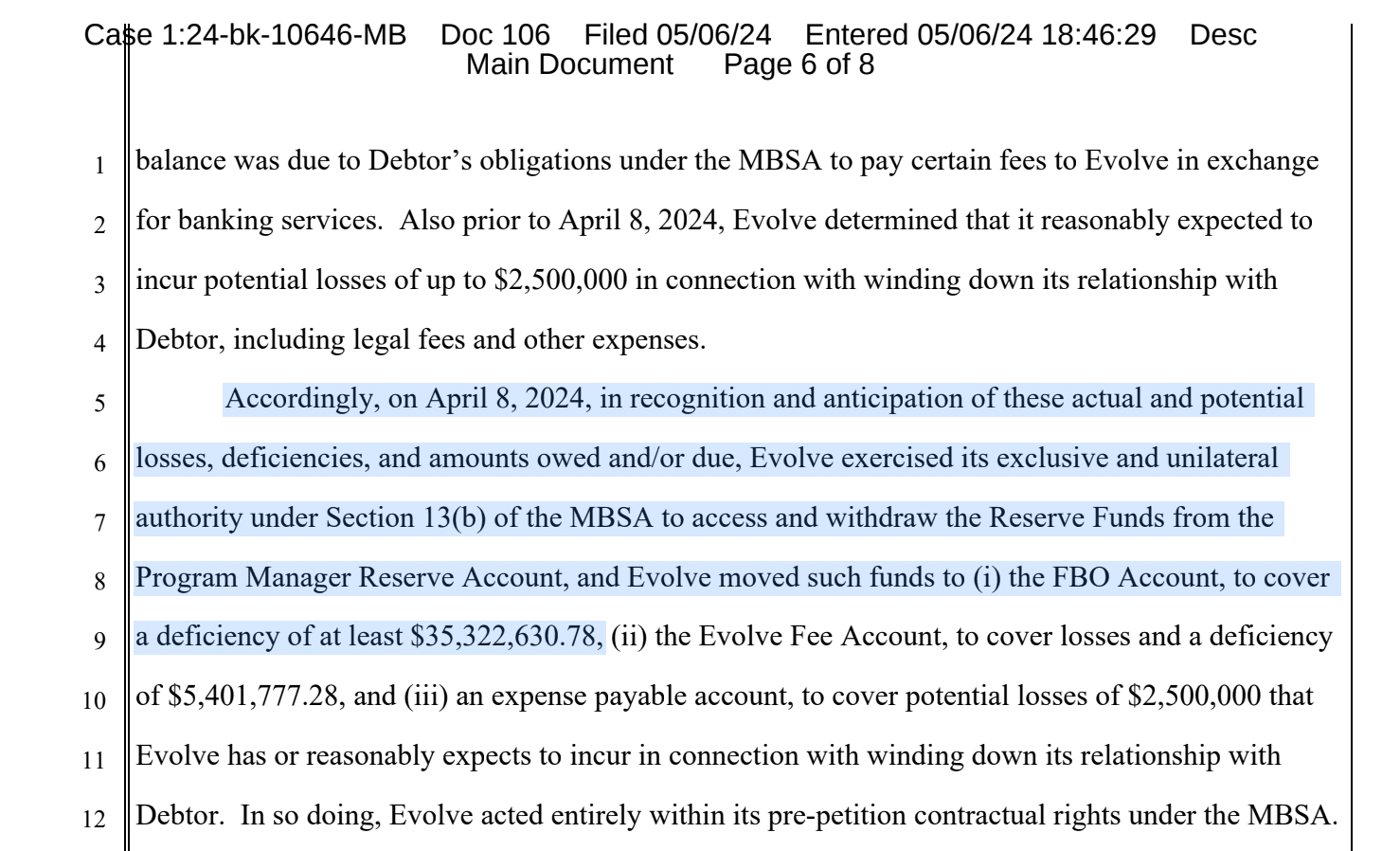

We inquired if the ~$35 million has indeed been moved from Evolve’s reserve account into the FBO account for disbursement to users. Initially, Evolve’s lawyer stated that this amount had not moved. However, when reminded that Evolve had previously reported (screenshot added below) moving this sum on April 8, the lawyer backtracked, eventually claiming that the ~$35 million was indeed in the FBO account but would only be used for disbursals “if required.” This conflicting information raised significant concerns, suggesting potential misreporting in prior hearings.

3. Uncertainty Around Reserve Use in Disbursements:

Since Evolve’s lawyer mentioned that the reserve amount will be used in the disbursals “if required”, we questioned why Evolve still seems unsure if the reserve amount has been used in disbursements given that the reconciliation is now complete. Evolve’s lawyer was unable to provide a clear answer.

During the hearing, other Synapse partner banks, AMG National Trust and Lineage Bank, confirmed that they had disbursed funds based on the Synapse trial balance report. Lineage further clarified that previous discrepancies were later resolved as more data became available to them. This hearing positioned Evolve as the only bank disputing the Synapse Trial Balance Report, while others have proceeded with disbursements based on the Synapse Trial Balance Report. Further, both AMG and Lineage underscored that Evolve is an outlier in this process, in a joint statement filed along with the trustee's status report under Exhibit A.

The former CEO of Synapse also made a significant appearance, calling out Evolve Bank's failure to meet even the most basic banking standards. He emphasized that all end users had checking account agreements with Evolve, yet the bank has failed to provide user-level statements—an essential and fundamental requirement for any banking institution. He also challenged Evolve to make its reconciliation details public given the lack of transparency and the confusion it has caused amongst end users.

The Trustee reported contacting regulatory bodies (OCC, FDIC, Federal Reserve, SIPC, FINRA) in past months and expressed frustration at the lack of action. The Trustee recommended bringing greater attention to the Federal Reserve, Evolve’s primary regulator, through individual stories and complaints. Affected users can file complaints to the Federal Reserve Consumer Help (FRCH) through their website using the

or by calling them directly at 1-888-851-1920.

Juno stands firmly with the community's efforts to secure End Users’ access to funds. We have previously reached out to the Federal Reserve and will continue our advocacy with the goal of holding Evolve accountable for the issues impacting end users of fintechs like Juno and Yotta. Juno urges everyone affected to join the movement at

.

On December 3, 2024

A frustratingly familiar story for fintechs and end users

: Another Synapse bankruptcy hearing. More excuses from Evolve. Still no real answers. Evolve’s refusal to provide clarity has left everyone stuck in an endless waiting game. It’s painfully clear that their lack of transparency, ongoing delays, and refusal to answer even the most basic questions have become the new normal. Despite numerous attempts to gain clarity, both users and Juno are met with nothing but stonewalling.

In the recent hearing on December 3, 2024, the Chapter 11 Trustee for Synapse submitted the

and a hearing was held to discuss the same.

The recent bankruptcy hearing revealed a deeply troubling reality: both the Trustee and the Judge expressed frustration over the lack of progress and regulatory action. In an emotional statement, the Trustee acknowledged that, at this point, litigation appears to be the most viable path forward for end users seeking resolution.

In the hearing, Juno’s legal counsel raised 2 critical questions with Evolve regarding the distribution of user funds specifically seeking clarification about:

- Distribution of Remaining Funds: Evolve’s recent report claimed that nearly $24.7 million had been distributed to end users across fintechs. However, they had previously reported holding $46.9 million in end user funds. Juno inquired as to why the remaining balance has not been distributed and what is Evolve's plans to distribute those funds.

- Reserve Funds Held by Evolve: Juno asked how Evolve plans to distribute ~$35 million held in the reserve account by Evolve, pressing for clear answers on when and how these funds will be distributed to the end users.

Evolve has refused to address these inquiries—or any questions from users—citing their involvement in class action lawsuits, leaving both Juno and the affected users deeply frustrated. As of now, Juno is aware of three active class action lawsuits related to the access of funds issue that mention Evolve as a defendant.

Key Takeaways from the hearing

:

- Evolve’s lack of transparency and their tight lipped approach of not addressing any critical questions raised by Juno and end users citing their ongoing legal suits has left everybody extremely dissatisfied and irate.

- The appeals process from Evolve continues to face significant issues, including website errors and delays.

- The Judge expressed disappointment over the lack of involvement from regulators such as the FDIC and urged the regulators to take action in support of the users. The Judge emphasized that these regulatory bodies must step up and advocate for the rightful recovery of users' funds, as their absence so far has left many without the protection they need.

In the trustee’s report, AMG National Trust and Lineage Bank submitted a joint status update mentioning that they have reconciled all Synapse-related money movements in and out of both institutions. Further, they mentioned that they have also reconciled the transactions between the two institutions and are working on a combined report of Cash Flow Summaries to share with the Trustee.

AMG, in its individual report, confirmed that it has never combined non-Synapse Brokerage funds with Synapse Brokerage accounts and that no other accounts at AMG are related to or relevant to Synapse. Additionally, AMG provided a summary view of reconciliation of Synapse Brokerage accounts held on behalf of its customers since AMG began accepting deposits from Synapse Brokerage in August 2023. They further challenged each bank to produce a similar view, suggesting that if all banks follow suit, the underlying issues could be identified.

On January 8, 2025

The recent Chapter 11 bankruptcy status conference held on January 8, 2025, revealed a number of critical updates regarding the ongoing reconciliation efforts of Synapse Financial Technologies, Inc. and its banking partner, Evolve Bank & Trust. The hearing highlighted the challenges users and fintech platforms continue to face as they await access to their funds, with no clear resolution in sight. The link for the - fourteenth status report.

Challenges in Extracting Transaction Data

One of the most significant challenges discussed at the hearing was the trustee’s inability to extract individual transaction data from Synapse's systems. Trustee Ms. McWilliams acknowledged the limitations of her team’s technical capabilities, emphasizing that despite having access to the Synapse database, there is no way to extract individual data points that could clarify the status of funds for end users. This lack of access has left many users in the dark about their balances, fuelling frustration among stakeholders.

To mitigate this, the trustee's team is distributing 30,000 trial balance records to partner banks in an effort to facilitate global reconciliation. They are also collaborating with a third-party ledgering software company that has volunteered its services to assist with the reconciliation process.

Evolve’s Non-Engagement: An Ongoing Concern

Evolve Bank & Trust has effectively adopted a position of non-engagement, consistently refusing to provide substantive responses to critical inquiries raised during the hearings. Citing its involvement in ongoing class action lawsuits as the sole justification, Evolve has continuously evaded addressing the core issues. Moreover, Evolve has not reported the total end user funds that were disbursed by them as of date in the trustee’s recent report. This lack of transparency has significantly delayed the resolution process and further compounded the uncertainty faced by affected users. The company's reluctance to provide transparency and cooperate with the trustee has left many fintech platforms without the information they need to assist their users.

The Road Ahead: What’s Next?

As the reconciliation process continues, the next status report is expected in February 2025. The trustee has expressed hope that more progress will be made, but the road ahead remains uncertain. The trustee stated that she plans to send a letter to the IRS Commissioner seeking guidance on how users should handle the tax implications of the funds they have lost access to. She acknowledged that clarification from the IRS was needed on how these losses should be treated for tax purposes. Ms. McWilliams also mentioned that after the change in administration on January 20, 2025, she intends to reach out to the relevant government agencies and administrators to secure the support needed for further action in this matter. She expressed hope that this would help expedite the resolution of the ongoing issues.

How does this impact you?

- All programs that work with Synapse are impacted by this. Incoming & Outgoing ACH transfers, Incoming Wire Transfers and card transactions will not go through until the banks restore their services. Direct deposits and other incoming transfers will be returned back to the source during this period.

- As stated in your brokerage account customer agreement, customer funds in the Synapse Brokerage Program are deposited in a network of member FDIC banks. Funds held in these banks are eligible for FDIC insurance up to $250,000 for each individual account.

Please note that Synapse Financial Technologies, Inc., has filed for Chapter 11 and not Synapse Brokerage LLC. Evolve Bank & Trust in a recent

, has stated that “As a robustly well-capitalized FDIC institution exceeding the capital thresholds for the highest category of capitalization under PCA (“well capitalized”), our primary focus is on ensuring the protection of end user funds."

Where are the funds and when can end-users get access to their funds?

We know this is frustrating for you, but we currently lack sufficient information regarding the exact location of the end-user funds. We understand the importance of this matter and are working around the clock to get ACH and card processing restored, which will enable customers to transact. Ultimately, it is up to Evolve Bank & Trust to restore card services, and Lineage or Evolve Bank & Trust or another processing bank to restore ACH services.

Please note that Juno does not or has never held end user funds and hence we have limited visibility in the ongoing issues and reconciliation process. We are sharing what we are made aware of or what is publicly available.

What we are doing about it

- Juno, on May 17, 2024, also represented end-user concerns to the federal US court overseeing these issues between Synapse and Evolve Bank & Trust. The court has directed the parties involved to meet and confer and find a resolution. The court felt that fintechs like Juno had no role to play in being a part of this mediation process to reach a resolution. Since then, our legal counsel has continued to represent end users' concerns in multiple bankruptcy hearings.

- Our compliance team has reached out to the Federal Reserve Board which regulates Evolve Bank & Trust and FINRA which regulates Synapse Brokerage LLC to make them aware of this situation.

- We are also working on providing a new treasury account for users so that you can start getting your direct deposits, pay bills or buy crypto again. Our team is working tirelessly in the interest of our users and community. We hope to provide these new accounts to users in the coming weeks.

This entire situation has been incredibly difficult and frustrating for us as well and the entire team who has been caught in the crosshair of an ongoing issue between Synapse and Evolve Bank & Trust. We have had very limited visibility and information of the whole situation and our team is only communicating what we are made aware of or what is publicly available. Juno is a financial technology company, not a bank. We do not custody cash or crypto and work with regulated partners to provide these services.

We are as disappointed as you are with these sequence of events. This has been extremely difficult for our team and our business. We understand that the trust of our customers, which we have worked incredibly hard for over the years, has been severely impacted. We are going to work extremely hard to regain your trust and rebuild our business. Please remember that every single member of our team is completely dedicated to serving you and your interests. Our team is working nights and weekends to figure out a solution and create an alternative path to restore access to essential financial services.

Over the last 6 months we have attempted several times to diversify our banking stack and even spent 3 months of engineering resources to integrate with a new partner. Given that our platform offers crypto adjacent services, it has been incredibly difficult to get a final approval from a bank partner to onboard customers. This is a broader problem specific to the crypto industry due to the current regulatory climate not being favourable to crypto or crypto adjacent companies.

If you have any questions or need any assistance, please feel free to reach out to our support team. Our support team is working round the clock to answer your questions and share whatever information is available to us.

*Approval for a Jiko account, which powers the Juno Treasury Account, involves compliance with US banking regulations. The creation of a Jiko account is subject to such approval.