Crypto

•

6 mins read

•

September 02, 2021

Juno Explains: Crypto Taxes

Your guide to understanding if you need to pay taxes on crypto, how to go about doing it, and current tax rates.

Although cryptocurrencies have been around for a while, their recent rise in popularity as a

in the United States has led to a rapid change in rules, laws, and regulations. The IRS is constantly changing their stance when it comes to cryptocurrencies, including taxes, which makes the world of cryptocurrency increasingly complicated.

This is especially true because cryptocurrencies often fall under the category of short-term capital gains, or profit on an investment that has been held for less than 1 year, though more and more people are holding on to their cryptocurrencies for longer, making them long-term capital gains which are profits on investments held for over 12 months. However, with this guide, we’ve covered everything you’ll need to know about paying taxes on your cryptocurrency.

Note that tax laws on cryptocurrency vary significantly from country to country, so this article only covers what to do if you buy and sell cryptocurrency in the United States.

Do I Have to Pay Taxes on My Crypto?

Yes, you are required to report gains and losses on each cryptocurrency transaction, even if your gain or loss is minimal.

The IRS identifies cryptocurrency as property, not currency, so

is taxable. As such, while the trade of cryptocurrency itself isn’t taxable, any

you make from trading cryptocurrency is taxable. This applies to all cryptocurrencies,

.

So, paying for goods or services with a Stablecoin or receiving Stablecoin in exchange for goods or services is a taxable event, but buying Stablecoin for cash and holding onto it in your wallet is not considered taxable.

If you are given a gift of cryptocurrency, it will become taxable when you have the ability to trade, buy, or sell it. If it’s merely sitting in your wallet, though, it isn’t taxable. You can also gift up to $15,000 worth of cryptocurrency per year without paying taxes. If your gift exceeds that amount, you will need to file a gift tax return.

However, a donation of crypto isn’t taxable. If you donate cryptocurrency to a

.), you can claim a charitable deduction and, therefore, don’t need to pay taxes.

How to File Your Crypto Taxes

In order to calculate your taxes on cryptocurrency, you will need the following information:

- The amount & currency of the coin or token sold

- Fiat value at time of acquisition

- Date of acquisition

- Fiat value at time of trade or sale

- Date of sale

With this information, you can begin to calculate your capital gains or losses. For instance, if you bought Litecoin for $5,000 — including fees — and sold it for $7,500, your gains would be $2,500. If, more than a year later, you sell this Litecoin for $10,000, your longer-term capital gains here are also $2,500. In total, you’ve made $5,000.

Of course, it can get complicated quickly. Say you bought Bitcoin for $1,000 in 2000, but paid $15,000 for it in 2010 — and then sold one coin for $20,000 in 2020. You would need to select an accounting metric to determine what your capital gains were.

The First In First Out method, or FIFO, states that your capital gains in this scenario would be $19,000 because you use the first price you bought Bitcoin for. In Last In First Out (LIFO), however, you use the last price you bought the coin for so your capital gains would be $5,000.

Obviously, you’d want to minimize your gains and therefore the amount of tax on cryptocurrency you are responsible for paying, but no one method works best for every transaction. This is why using an

,

, or enlisting an accountant can be helpful when it comes to taxes on cryptocurrency.

What tax forms will you need to report taxes on cryptocurrency?

- Form 8949, which reports each cryptocurrency transaction;

- Include the totals from Form 8949 on your Form Schedule D;

- All crypto income needs to be reported on Form 1040 Schedule 1 (but use Schedule C if you are engaging in crypto transactions as someone who is self-employed).

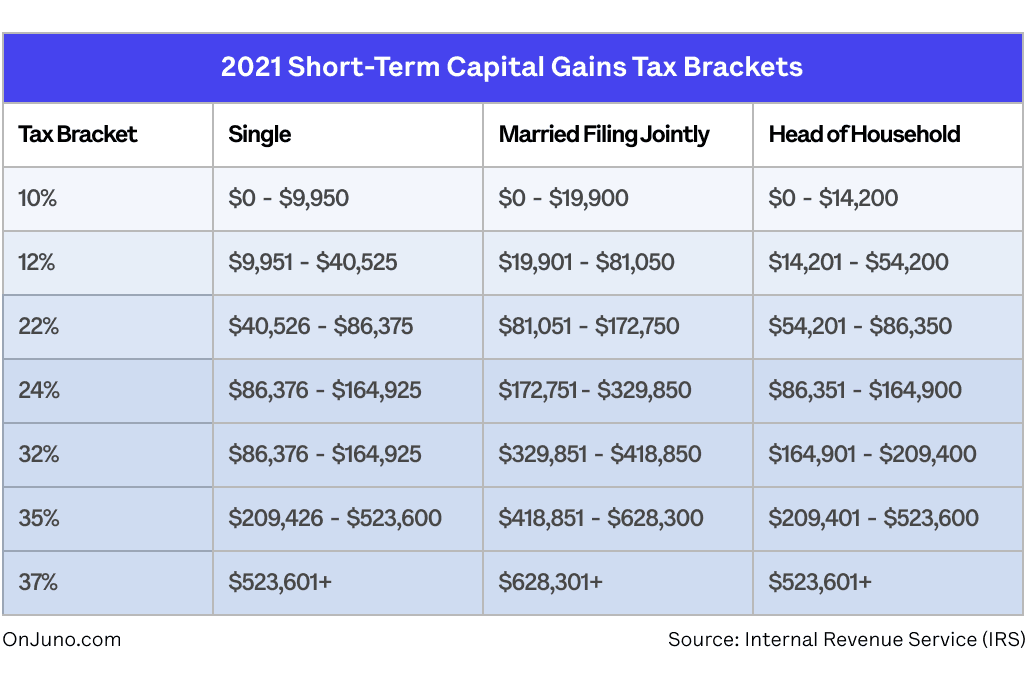

Short-Term Capital Gains Tax Rate

If your cryptocurrency has been held and sold for 365 days or less, then it is subject to short-term capital gains tax, being considered ordinary income.

Here are the 2021 IRS tax rates for short-term capital gains:

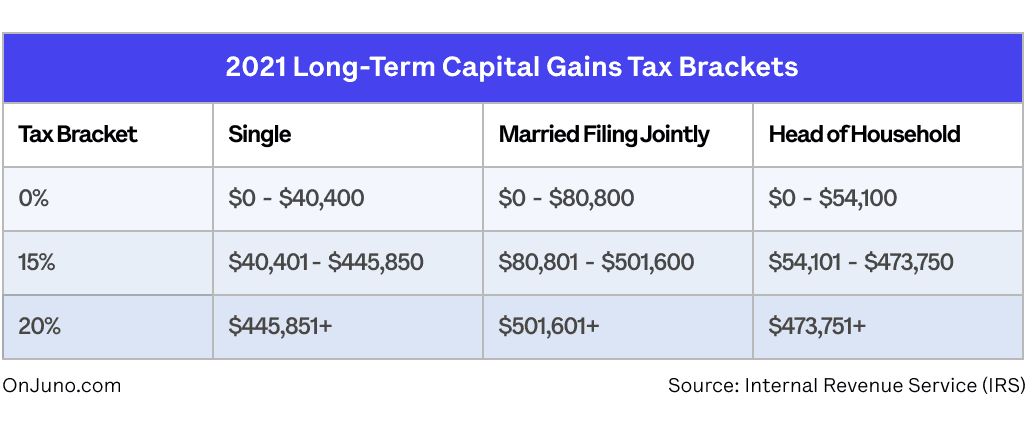

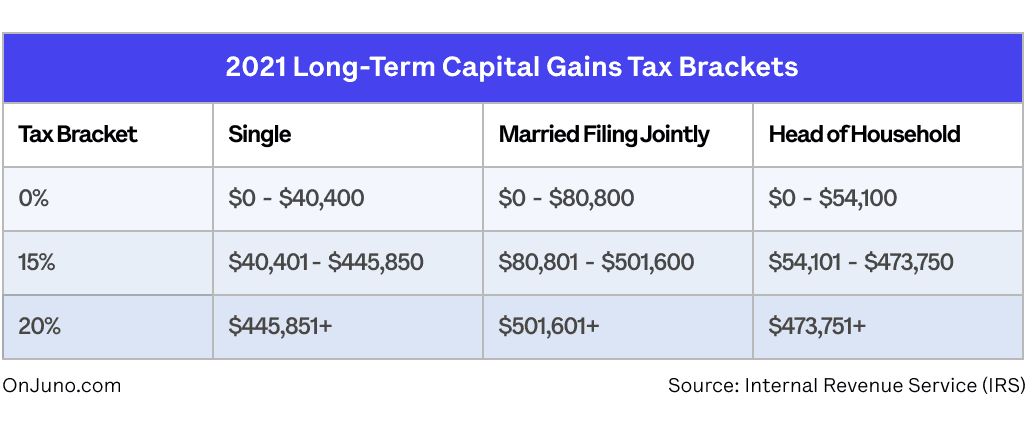

Long-Term Capital Gains Tax Rate

If your cryptocurrency has a holding period of more than 365 days, it will be taxed as a long-term capital gain with a liability of 0-20%, based on your income tax rate.

Here are the 2021 tax rates from the IRS for long-term capital gains:

Ultimately, taxes on cryptocurrency don’t need to be difficult, but they do require a degree of planning and time. If you maintain your paperwork and other cryptocurrency records, however, you should be able to report your taxes without an issue.