Personal Finance

•

2 mins read

•

July 16, 2020

Citibank Checking and Savings Account Fees, 2020

Fees and charges associated with the Citibank checking and savings accounts

In search for a new bank account to store, save or spend your hard-earned money? Be warned! Behind those bright billboards of smiling grandmas in newly outfitted veneers lie a labyrinth of hidden fees. Large banks want you to believe that their accounts are free and easy to use. Dig deeper and you’ll find more than fifteen different charges waiting to entrap you - from monthly maintenance fees to overdraft and wire transfer fees.

But fret not champ!

We’re here to help

. Read on to understand all the fees associated with the Citibank account.

Citibank Account Packages

Citibank provides a unique offering in the banking ecosystem by bundling both their checking and savings propositions under five packages, namely;

1.

Citi Access Account

- Entry level banking without overdraft facility

2.

Citi Basic Banking

- No-frills checking and savings

3.

The Citibank Account

- Full-feature banking with APY generating accounts, higher entry limits and access to Citi's Thank You Rewards

4.

Citi Priority

- Priority banking, dedicated support and access to wealth management tools

5.

Citigold

- Personal wealth management with $200k+ minimum balance requirement

Citibank Checking Account Fees

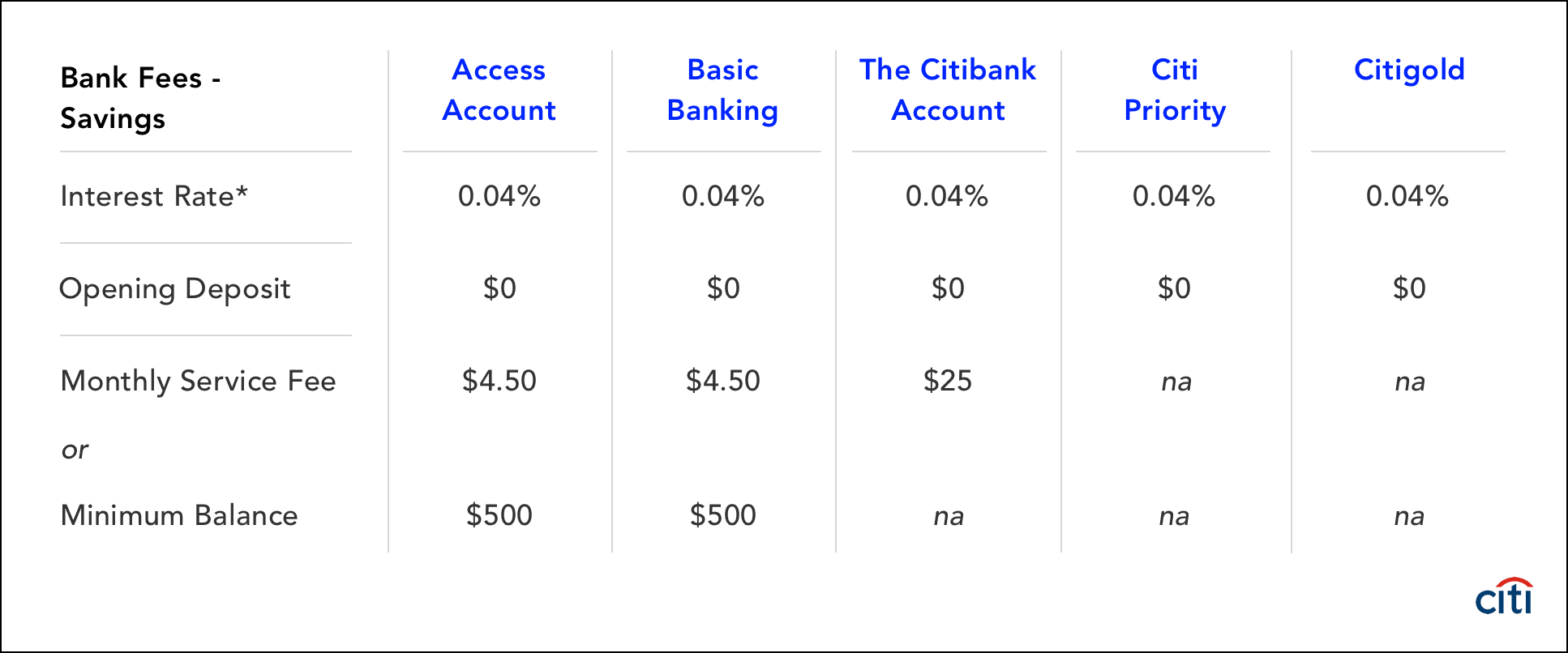

Citibank Savings Account Fees (

interest rates for deposits under $10,000)

Citibank Wire Transfer Fees

- Incoming domestic wire transfer fee → $15

- Incoming international wire transfer fee → $15

- Outgoing domestic wire transfer fee → $35

- Outgoing international wire transfer fee → $45

Citibank Additional Fees & Charges

-

Overdraft Fee

- $34 per overdraft.

- I

nsufficient Funds Fee

- Unlike overdraft, the NSF fee is charged when a payment is returned due to insufficient balance. Standard fee of $34 per returned item across all applicable accounts.

-

ATM Withdrawal Fee

- $2.50 for out-of-network withdrawals and $5 for international withdrawals.

-

International Transaction Fee

- 3% on all foreign transactions. Waived for Priority and Gold customers.

-

Cashiers Check Fee

- $10 per check. Waived for Priority and Gold customers.

Our Verdict

While Citibank offers extensive branch and ATM coverage, near-zero interest rates and a bevy of hidden charges make their basic checking and savings accounts an expensive proposition.

Quick Links

Bank Fees and Charges

Compare Interest Rates

Track Your Savings