Crypto

•

11 mins read

•

December 10, 2021

Bitcoin vs. USDC: What's the Difference?

The world’s first cryptocurrency vs. one of the world's biggest stablecoins. Read on to know what makes these cryptocurrencies stand out from the crowd.

Bitcoin vs. USDC: What's the Difference?

The world’s first cryptocurrency vs. one of the world's biggest stablecoins. Read on to know what makes these cryptocurrencies stand out from the crowd.

Navigating through the cryptocurrency space as a newcomer is certainly challenging. There are

, but there is limited comprehensible information on their core competencies. All of this, understandably, makes people hesitant to enter the space.

However, with a basic understanding of the purpose, mechanism, utility, and future scope of cryptocurrency, you can easily understand what makes this unique.

And when it comes to Bitcoin vs. USDC, here’s our take.

Bitcoin: An Overview

Bitcoin is the world’s first cryptocurrency, introduced in 2008 by

as a means to exchange goods and services on the blockchain. Satoshi Nakamoto is believed to be a pseudonymous individual or team who published a

outlining how the technology worked.

The core competency of Bitcoin is relatively simple: it’s digital money issued in a decentralized ecosystem that enables secure P2P (peer-to-peer) transactions over the Internet. With a

, Bitcoin has grown exponentially over the years. As of October 25, 2021, the price of a single Bitcoin was $61,658.00 as compared to $434 on 1st January 2016.

The maximum limit of Bitcoin is restricted to 21 million coins, which is why many

. With time, institutional investors are also expected to start using Bitcoin as “digital gold” to hedge against volatility and inflation.

USDC: An Overview

USD Coin (or USDC) is a popular stablecoin based on Ethereum.

for developers to create different apps and tokens.

USDC was developed by

and launched on September 26, 2018, in collaboration with Circle and Coinbase. USDC is a service to tokenize US dollars and act as a gateway for their usage over the Internet and public blockchain.

Now that we have a basic understanding of Bitcoin and USDC, let’s dive deeper into their differences, through the lens of 3 broad factors:

1. Technical Architecture

2. Utility

3. Future Scope

Technical Architecture

Architecture of Bitcoin

. What this means is that, even though Nakamoto is no longer controlling the network, it is developed and maintained by the Bitcoin community, who manage it on a voluntary basis. Bitcoin is not governed by a bank, government, or any other central entity.

Bitcoin is created when it is ‘mined’ by the members of the network. Unlike fiat currencies that are issued by central banks, new Bitcoin are issued to miners via a block reward for adding new blocks filled with verified transactions to the Bitcoin blockchain.

This is achieved by solving a complex computational problem using specialized hardware to produce a hash. Simply put, a hash is a seemingly random 64-character output that requires a lot of permutations and combinations to obtain.

Once this hash is identified, the block is closed and is added to the blockchain. After successfully mining a block, miners are rewarded with newly-created Bitcoin and transaction fees.

The Bitcoin in this blockchain are then brought into circulation for trading, investment, and transactional purposes.

Architecture of USDC

USDC is a centralised cryptocurrency. It relies on an issuer and an underlying pool of collateral. Developed by the Centre Consortium, USDC is based on the open source asset-backed stablecoin framework.

It has an open membership that allows eligible financial institutions to participate. USDC offers a solution with comprehensive financial and operational transparency. It operates within the regulated framework of US money transmission laws, with established banking partners and auditors.

USDC is not mined. Instead, it is

issued

whenever a customer ‘buys’ a token from an approved issuer. For every US dollar received, the issuer will apply an

to create an equivalent amount of USDC.

This contract is then shared with the customer who bought the token. The US dollar originally received by the issuer is subsequently held in

as collateral.

The customer, on the other hand, has their USDC that is redeemable against the issuer for an equivalent amount of US dollars. This complex yet stable architecture is the reason USDC doesn’t see its value swinging dramatically in the middle of a transaction.

Utility

Utility of USDC

As mentioned earlier, USDC is a stablecoin created with the intention of circulating the US dollar in the blockchain network.

This brings us to some of the key use cases of USDC:

1.

Easier access to crypto markets:

USDC is pegged to the US dollar and is accepted on almost every cryptocurrency exchange, giving you an easier entry into the cryptocurrency ecosystem.

2.

Instant international transactions:

USDC is a convenient option to transact US dollars almost instantly without undergoing the complex procedures of central banks. It is also more economical with lower transaction fees.

3.

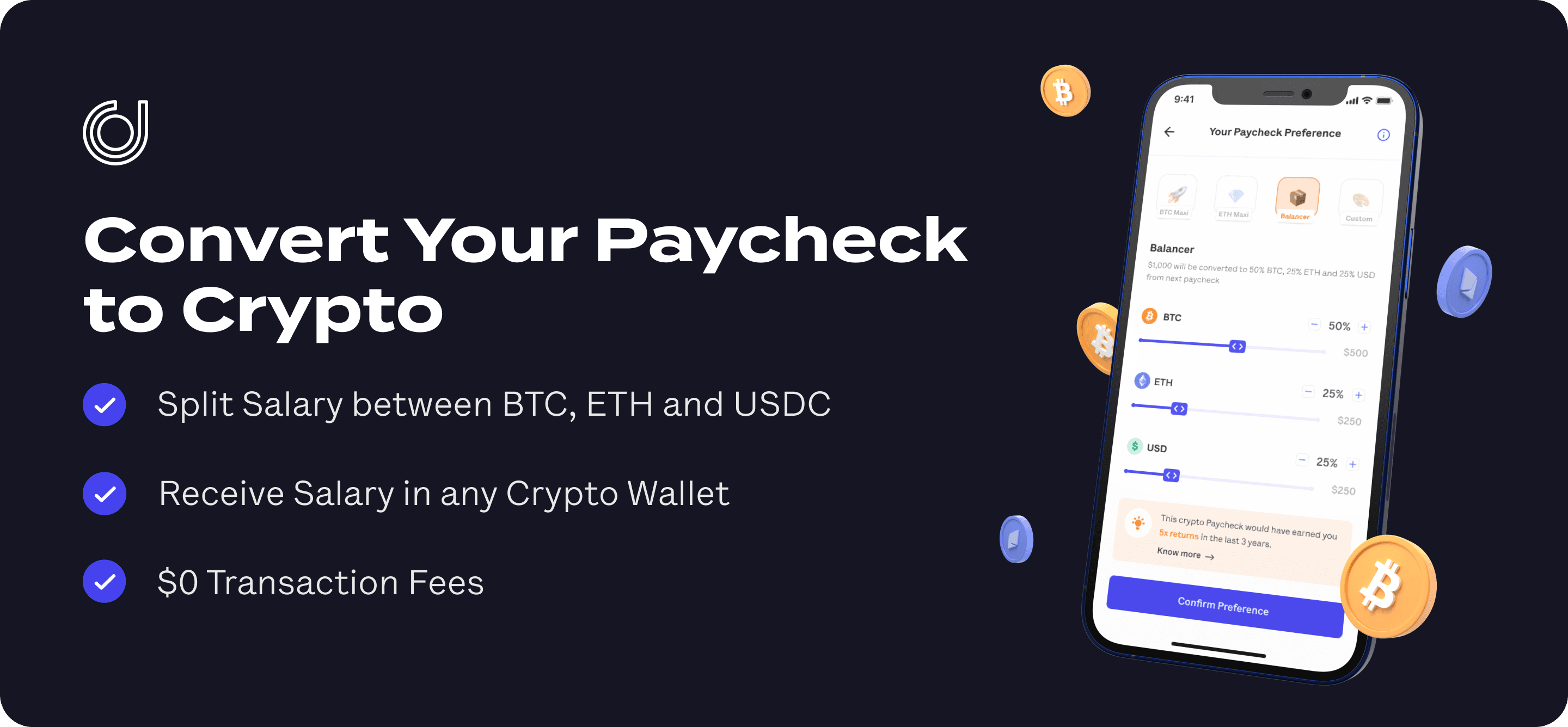

Pay/earn in crypto:

The idea of getting your paycheck in crypto is

. In fact, you can now get a part of your

. All you have to do is pick a currency, set up a direct deposit, and select your wallet. However, most cryptocurrencies are volatile in their value, which makes accounting much more complex. With USDC, employers and employees won’t face this problem as its value will remain constant.

4.

Rapid governmental aid:

The robust nature of the blockchain ecosystem allows governments to easily release funds for urgent causes.

5.

Global mainstream adoption:

Traditional financial institutions have always viewed cryptocurrency as a volatile and young ecosystem. However, with USDC, the

and finance players are finally beginning to take note.

Utility of Bitcoin

Bitcoin was initially introduced to conduct peer-to-peer transactions globally in a decentralized network. It presented a solution to exorbitant central banking systems. However, in recent years, Bitcoin has found itself being regarded as a potential long-term store of value.

A store of value refers to assets that retain or increase in value in times of recession. Gold is an example of a store of value — especially when its value went up by 200% in 2008 while most equity, fixed income, currency, commodity, and real estate markets simultaneously collapsed.

And just like gold, Bitcoin is limited in number. No central authority can alter the supply of Bitcoin. This singular trait isolates Bitcoin from inflation. Hence Bitcoin is now used by financial institutions to hedge against fiat currencies,

”.

In fact, the extensiveness of Bitcoin’s reverence as a store of value has extended to MNCs. US-based electric vehicle and clean energy company Tesla, Inc. recently invested about $1.5 billion of its companies cash in Bitcoin.

This represents about 8% of their cash holdings of $19.4 billion at the end of 2020. Similarly, Square, Inc., a financial services and digital payments company based in San Francisco owns 8,027 Bitcoin in total.

This accounts for about 5% of their cash. In fact, as of February 24, 2021, MicroStrategy, Inc. holds an aggregate of approximately 90,531 Bitcoin. This is more than any other company in the world.

The one common trait between all these companies is the fact that their CEOs are known Bitcoin advocates.

Future Scope

The future of the cryptocurrency ecosystem as a whole is optimistic. Even though it is a fairly young technological framework, its mainstream acceptance and adoption is a positive indicator.

The future of

with any sort of certainty because of its extremely volatile performance over the past decade. But what can be deduced as a certainty is its widespread adoption and gradual acceptance as a legal tender.

. Due to its limited circulation, Bitcoin will continue to operate as a store of value. Overall, the future scope of Blockchain remains optimistic with some

.

USDC on the other hand is non-volatile, predictable, and issued by a central authority. It is therefore predicted to migrate day-to-day fiat currency transactions to the blockchain network.

In fact, the

for Circle to become a full reserve national digital currency bank. This move is supported by the proliferation of stablecoins.

The distinctions between Bitcoin and USDC are easily recognizable. They differ in their technical architecture, their purpose, and their future scope. However, the trait that unites both these currencies is simple. Both are positive case studies that reinforce and legitimize the Web 3.0 blockchain ecosystem.