Personal Finance

•

5 mins read

•

July 16, 2020

Why Americans pay $329 in bank fees every year

Understand why legacy financial institutions overcharge and underserve

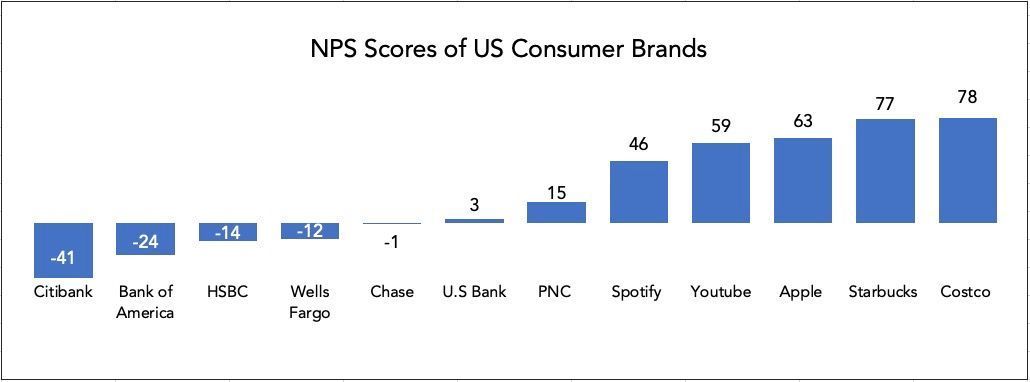

At a time when public trust in financial institutions remains questionable (the top 5 US banks have an average NPS score of -15), banks are insistent on burying retail customers under a myriad of banking fees. If you were to open a bank account today, you’re looking at up to

different types of charges on your regular deposits - from monthly service fees to overdraft fees to inactivity fees to the most ridiculous one of them all, the account closing fee.

In an age where Amazon lays out a bevy of retail goods at free two-day shipping and where Spotify lets you access all the music ever made for the price of a venti vanilla bean frappuccino, we’re all stuck in financial dystopia, paying big banks up to $329 a year for the privilege of

using our own money

.

Bad habits die hard

Benjamin Franklin once famously remarked that there were only two things certain in life - death and taxes. But Benjamin Franklin never owned a 21st century checking account. As predictable as a metronome, banks have continued to hike services fees at a rapid clip, transforming the once 'free' checking account into a deceptive labyrinth of hidden charges.

- Large banks collect upwards on

on overdraft fees. JPMorgan Chase, Wells Fargo and Bank of America all make upwards of

annually by charging the very same customers who exhibit an inability to pay.

- Monthly service fees have risen

over the last 8 years. The average retail customer pays upwards of $170 just to maintain their accounts.

- The average minimum balance required to open an account is

, posing significant entry barriers for underbanked populations to enter the financial markets.

- Using your debit card internationally accrues a 3% charge per transaction, which is avoidable were it not for the fat margins banks place on currency conversions

- Sending money abroad incurs a minimum $50 charge + another 3-5% on currency conversion. If you were to wire transfer $1000 internationally today, Bank of America would charge you a $30 wire fee + $34.5 currency exchange rate margin = $64.5 total fees. That’s

of the amount wired!

3 reasons why banks charge sky-high fees

1.

Heavy operational costs

- In 2019 alone, JPMorgan Chase, the largest bank in the country, spent $6B maintaining its 5000-strong branch network and

for its 250,000 employees. The top 10 banks in total spend $18.6B to maintain their high-street presence. Financing such elaborate operations compels banks to squeeze every last bit of revenue from their customers.

2.

Aggressive consolidation

- While customer deposits have grown 3x since 1990 to $13.3Tn, the number of banks servicing them have shrunk 62%, driven by mega acquisitions like Wells Fargo-Wachovia and BB&T-SunTrust. Today, the 10 largest banks control almost half of all customer deposits. Shrinking customer choice=more pricing power for banks=higher fees.

3.

2008 economic crisis

- Traditionally banks have operated on the fractional reserve model, storing a small percentage of customer deposits as security, converting the rest into credit and earning interest on these loans. However, over time, banks diversified revenue to other streams, which are grouped as non-interest revenue. This is mostly fee-based income, things like overdraft and ATM fees on the consumer end and securitization fees and investment banking on the corporate end. Post 2008, to stem growing losses from the financial and housing market crashes, banks turned to the one cash cow that would never retaliate - the retail customer, that is,

you and me.

The Cleveland Fed

that service charges, which held the smallest share of non-interest income in 2001, grew significantly, increasing from 14.0 percent of non-interest income in 2001 to over 25 percent in 2018.

Even though bankers often sermonize the deep relationship they build with customers, it is important to recognize banks for what they are. Simply put, they are storefronts of financial products - the student loan, the credit card, the 30 year fixed mortgage. Expecting a bank to look after your financial wellness is like asking your corner bodega to manage your diet. When push comes to shove (as things did in 2008), banks will always look to protect the financial product; the customer is but a bystander with a chequebook. And so, while we pen rambling editorials on the ills of the financial industry, banks will continue to overcharge and underserve customers because that is what their incentives compel them to do.

> Show me the incentive and I will show you the outcome - Charlie Munger