Personal Finance

•

4 mins read

•

December 14, 2022

High inflation in the US and why should you care

Everything you need to know about the US inflation

High Inflation: An overview

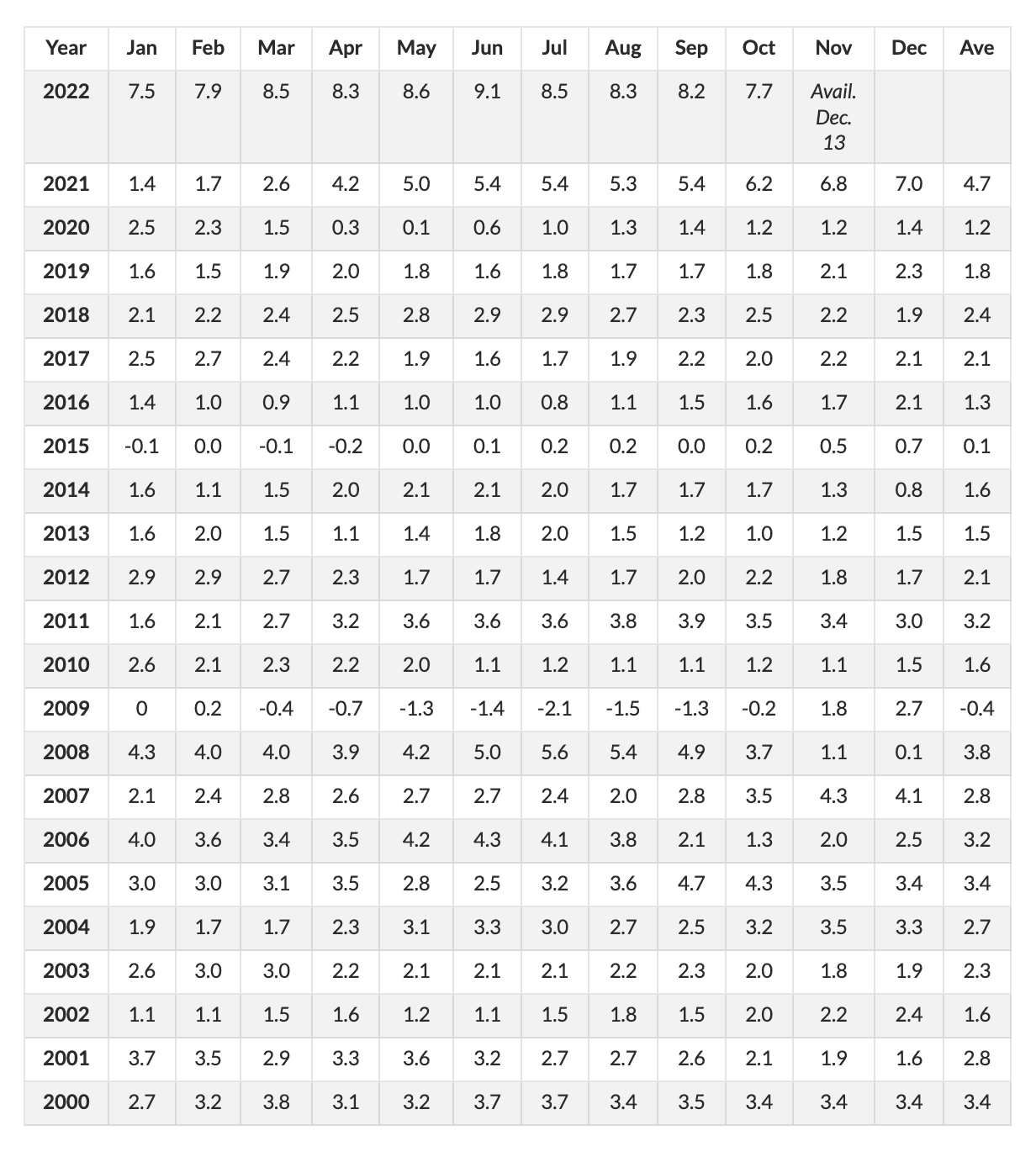

When you find yourself paying more for regular, everyday items in a span of a few months, it's an easy indication that inflation is high. Across the globe, high inflation has been a major economic concern. In 2022, rising inflation has particularly affected the US economy. Inflation levels in the US have had a median rate of 2% until Q2 2021. The highest was in June 2022 at

and it plateaued at

in October 2022.

Image Courtesy:

Whenever high inflation affects the US economy, the Fed intervenes by raising interest rates. Last year when the US inflation rate peaked above the median, the Fed's initial stance was that the rising inflation was

, and would eventually fall in place without any intervention.

But that didn't happen.

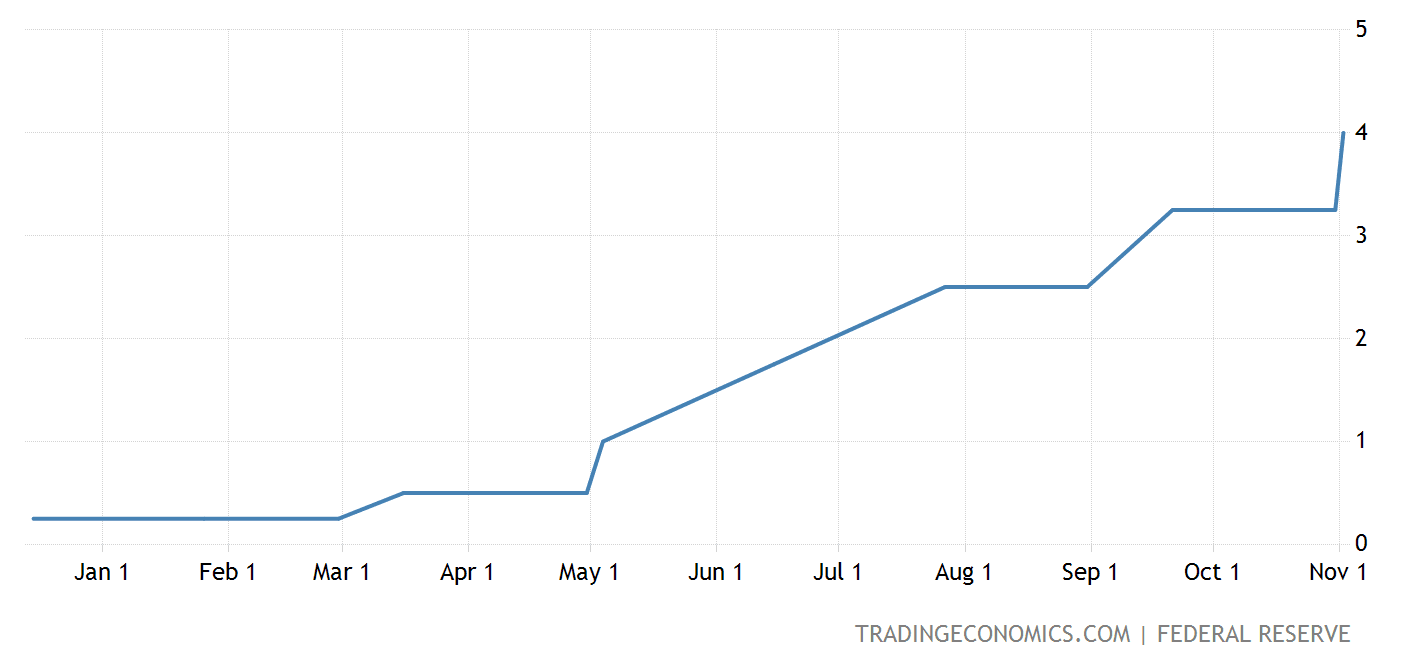

Every quarter witnessed a rising inflation trend, and eventually, the Fed stepped in to take control and increased interest rates from Q2 2022 by

. Over the last few months, the interest rates were increased at least 4 times, bringing the total Fed rate to 4% until November.

How do you define high inflation?

Inflation is the rate at which the prices of goods & services increase over a period of time. It is measured by the

(CPI), which is the average price of a basket of goods and services. In the US, the Bureau of Labor Statistics (BLS) calculates CPI, and the BLS collects about +90k prices monthly from some +20k retail and service establishments (containing food, groceries, etc.) to gauge the overall health of the economy.

When the CPI rises, it means that the purchasing power of the currency has decreased as the same amount of money can buy fewer goods and services. This affects individuals and households to purchase fewer essentials, and if the purchases fall, then it impacts the businesses and companies' periodic revenue cycles (monthly and quarterly). And eventually, it affects the GDP (Gross Domestic Product) of the economy, as GDP consists of all spending on goods and services within a period.

What causes high inflation in the US?

Historically, high inflation in the economy is caused by various factors, either one or a combination of the following:

1. An increase in the money supply by the government

2. An increase in government spending

3. And an increase in the cost of production

In March 2020, the entire global economy took a hit for the worse due to COVID-19. Due to the government-imposed lockdown, many businesses and corporations faced a demand crunch, eventually leading to downsizing their business and cutting down their workforce. As many US citizens lost jobs, unemployment rates shot up to

This created severe economic pressure on top of rising COVID numbers and badly affected the economy because consumers were only buying essential things like food, medicines, and groceries.

Around this time, the US Government took various steps to mitigate the economic slump by providing fiscal stimulus and relief. The US government issued a

to individuals, businesses, state and local aid, etc to alleviate some of the losses.

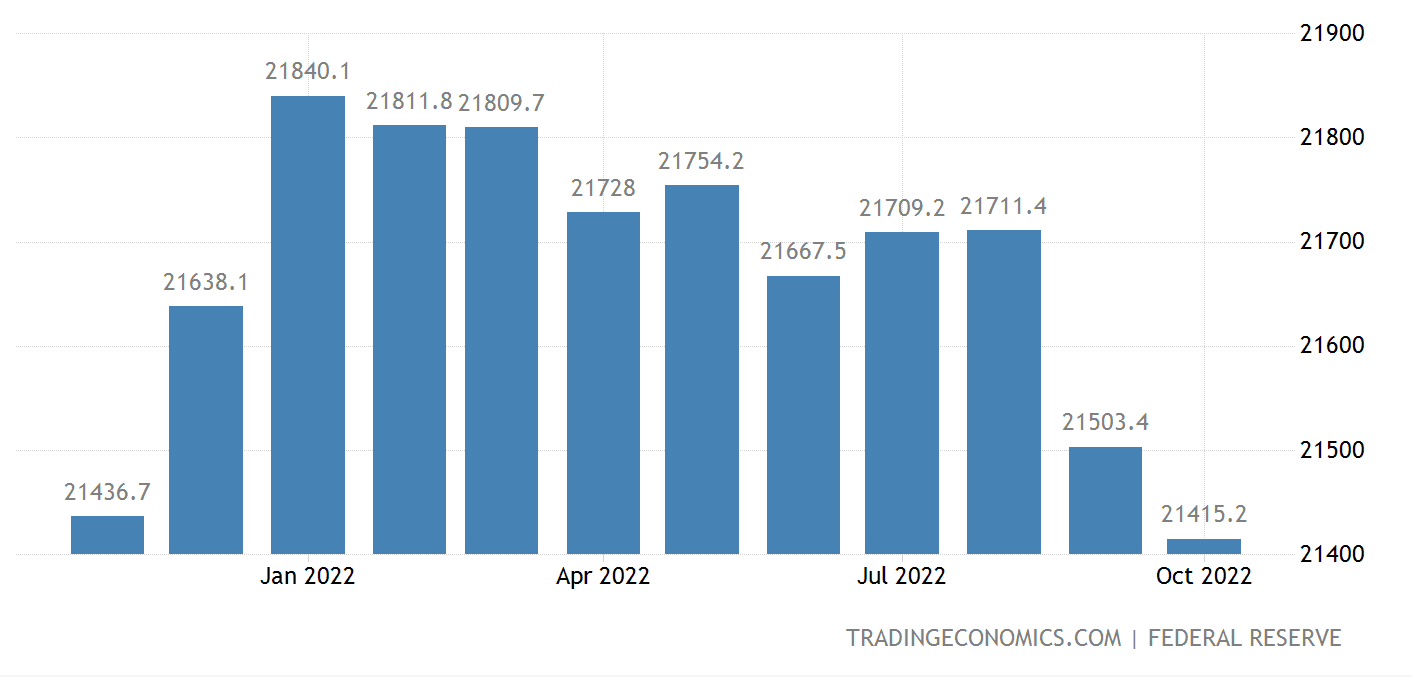

The excessive issuance of stimulus checks led to a gradual increment in the overall US M2 money. Rising M2 money was one of the many reasons the inflation rate gradually went above the norm.

Image Courtesy:

From the start of 2022, the effects of COVID diminished, but the excessive supply of money persisted, which led to gradual increments in the prices of goods and services that were reflected in the US CPI's inflation numbers.

How does high inflation affect consumers?

High inflation negatively impacts the economy. It can lead to decreased consumer spending as people cannot afford the rising prices. High inflation can also lead to a decrease in purchasing power. This is because consumers cannot purchase as much with their money as they could before and will only focus on buying essentials. This can lead to a decrease in the standard of living as people cannot afford the same quality of goods and services as they could before.

According to recent statistics shared by the Bureau of Labor Statistics, food prices have risen by

year over year, and energy and gasoline prices have also increased by 17.6% and 17.5%, respectively compared to 2021.

High inflation often leads to increased unemployment as businesses cannot afford to hire new employees and opt for layoffs due to rising costs. This can lead to an increase in poverty to the bottom percentage of the US population, as people lose jobs and cannot find new ones, and struggle to afford basic necessities. At the time of writing this piece, the US unemployment rates are fairly stable at around

Rising inflation numbers also affect the housing market as the median US home price is projected to fall 4% to

in the next year.

How the US government is fighting high Inflation?

The US government is taking measures to effectively raise Fed interest rates to combat rising inflation. Rising Fed interest rates affect all lenders of money - banks, financial institutions, etc. Thus, these banks lent out money to corporations, businesses, and even individuals. And these lenders are more likely to charge higher interest rates to compensate for the increased costs of goods and services.

This process helps in controlling the money supply and manipulating interest rates to reduce the amount of money in circulation. This can help reduce the amount of money in circulation, which can eventually help reduce the inflation rate over time.

From Q3 2022, the Fed has been taking measures to reduce inflation on account of rising interest rates. In November, the interest rate was 4%.

Courtesy:

Global Inflation

Not just US but countries worldwide are facing higher inflation numbers. While there are many other macro and micro environmental factors that drive high inflation numbers, there is no single cause or factor causing widespread inflation in these countries. In Japan, the core inflation rate has increased and reached a

. And in the UK, the inflation rate has reached

, the highest it has been in the last 41 years in the country.

IMF director Kristalina Georgieva has stated that the

, but it remains to be seen how true it is in the coming months.

What lies ahead in 2023?

Many economists already expect the high inflation rate to continue over the next few months. And they also expect the Fed’s aggressive policy response to continue by rising interest rates from here, eventually tipping the

next year.

Economists have also trimmed already dismal estimates for the economy in the first half of next year, and they won't expect economic numbers to recover unless the Fed pivots (reducing the interest rate from current numbers).

High inflation can be a serious problem for the US economy, and it is important to understand the long-term effects of high inflation on the economy. By understanding the causes and effects of high inflation, Fed is taking a considerate approach to raising interest rates that will effectively help lower the inflation numbers. Fed has maintained its stance on controlling inflation and bringing it to an effective median rate of

over the course of time.

Kunal Shivalkar

Kunal is a crypto native marketer and content writer