•

4 mins read

•

July 18, 2024

Announcing $18m Series A led by ParaFi Capital

Juno provides the account for crypto natives to earn, invest and spend cash. It aims to build an easy-to-use, trusted, and compliant gateway to crypto and web3. Juno has raised

$18m in a Series A

round to expand its digital banking product suite.

The Series A round was led by ParaFi Capital’s Growth Fund along with participation from Hashed, Jump Crypto, Uncorrelated Fund, Greycroft, Mithril, Antler Global, 6th Man Ventures and Abstract Ventures. Previously, Juno raised $3m in a seed round from Sequoia India’s Surge, Polychain Capital, Consensys Ventures and Dragonfly Capital.

Juno is also backed by high-profile crypto founders and angel investors including Balaji Srinivasan (ex-CTO of Coinbase) and Surojit Chatterjee (CPO of Coinbase), Ryan Selkis (Founder, Messari), Sandeep Nailwal and Jaynti Kanani (Founders of Polygon), Sriram Krishnan (General Partner, a16z), Venu Palaparthi (President, FTX Capital Markets).

"We at ParaFi Capital are glad to partner with the team at Juno. They are one of the very few teams we have come across who deeply understand both fintech and crypto. Seamlessly integrating crypto and web3 in your Juno account which is a trusted and familiar interface for millions of Americans can help onboard new users to web3."

"Their empathy towards users new to web3 and passion for creating beautiful crypto-native products with compliance at its core sets them apart. They are creating an entirely new category in neo banking and we are excited to back them".

—Ryan Navi, Principal at ParaFi Capital

About Juno

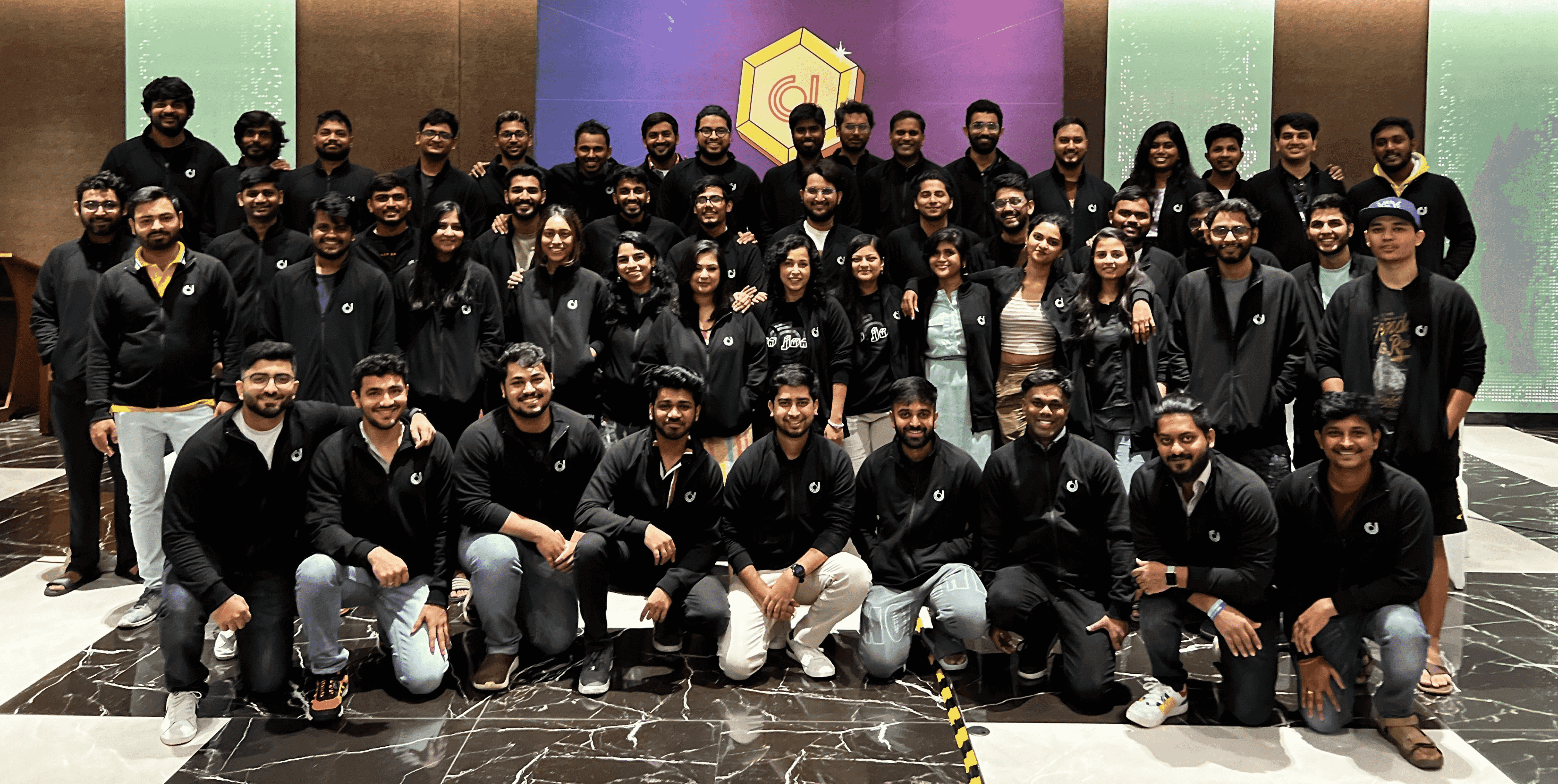

Juno was founded in 2020 by Varun Deshpande, Ratnesh Ray, and Siddharth Verma. The team had previously created Nuo protocol in 2019, one of the top 5 protocols in DeFi with significant scale. It was shut down in 2020 to pursue a more regulated approach to crypto with Juno.

Juno’s crypto-native banking platform is now processing over $1 Billion in annualized transaction volume, making it the most significant player in this category. Juno has seen a 10x user growth in the last 9 months, during one of the worst bear markets in crypto.

This is primarily driven by Juno's core use cases around using crypto for everyday transactions and easy access to crypto from the account. Juno also provides direct onramps from the account to Layer 2 blockchains like Polygon, Arbitrum, and Optimism for zero fees.

About ParaFi Capital

Founded in 2018, ParaFi Capital is a leading crypto-native digital asset investment and technology firm. ParaFi manages +$1B AUM across digital assets, venture equity, and quantitative strategies.

ParaFi employs a deeply technical approach to investing, leveraging the protocols and infrastructure they invest behind. ParaFi has backed many of the industry's pioneering innovators and protocols including Consensys, the creators of Metamask.