Personal Finance

•

5 min read

•

October 21, 2020

100-Year-Old Money Lessons That Stand the Test of Time

Money lessons from centuries past that you need now

Ringmaster and Money Master: P.T. Barnum

“Learn something useful.”

“Money is like fire, a good servant but an insatiable master”

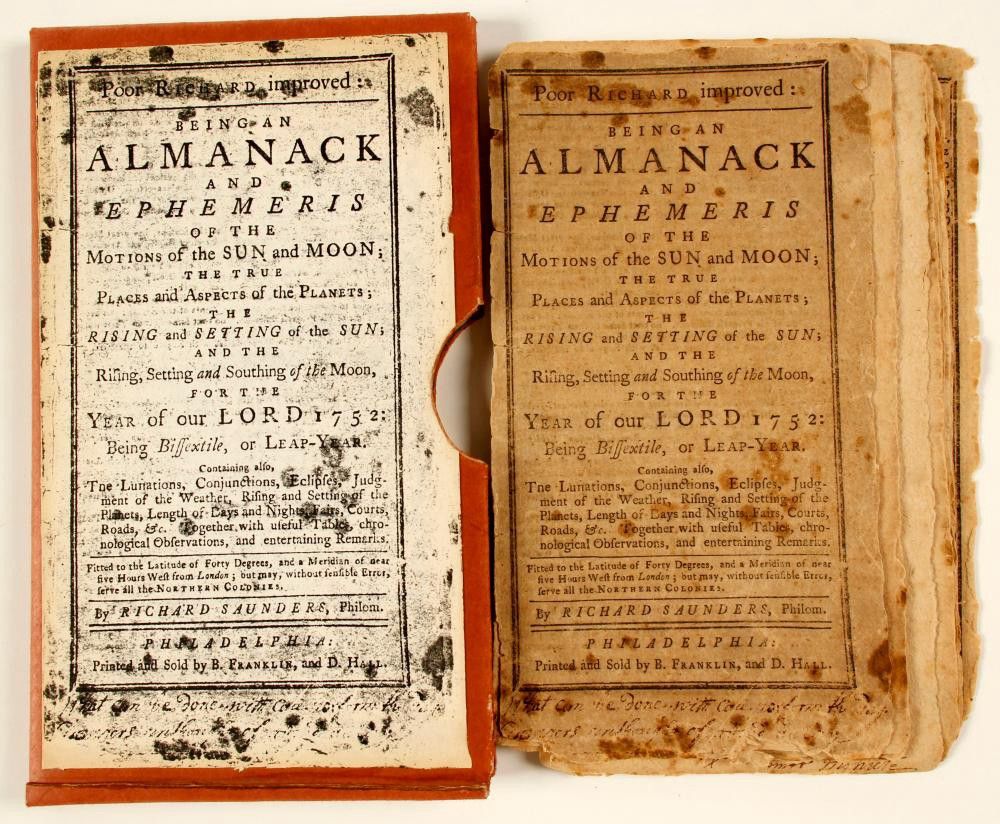

Benjamin Franklin: Telling It Straight Since 1732

“A penny saved is a penny earned.”

“Never leave till tomorrow what you can do today.”

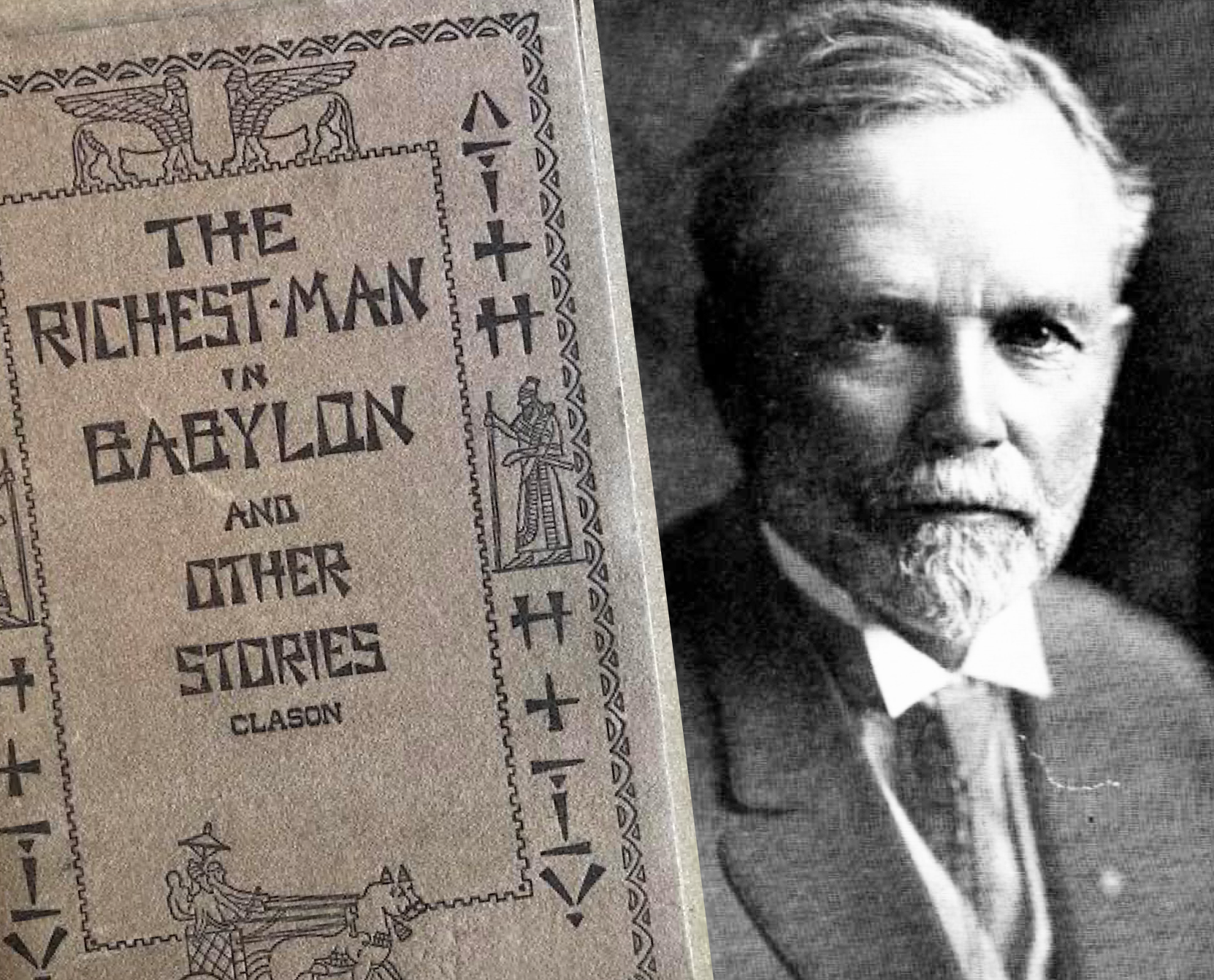

A Parable for the Ages: Lessons From George Clason

“Pay yourself first.”

“Confuse not the necessary expenses with thy desires.”

Persistence Pays According to Napoleon Hill

“Don’t give up.”

Start your

onchain journey

On-ramp to more than 20 chains with no holding period on crypto withdrawals

Juno (CapitalJ Inc.) is a financial technology company, not a bank. You acknowledge and accept that by continuing to use Juno's Site, App or Services you agree to Juno's Terms of Use and Privacy Policy.

Digital Assets Disclosures

Digital Asset services are provided by Zero Hash, which is not affiliated with Juno or Synapse. Digital Assets are highly speculative in nature, involve a high degree of risk and can rapidly and significantly decrease in value. It is reasonably possible for the value of Digital Assets to decrease to zero or near zero. Digital Assets held in your Zero Hash account are not protected by FDIC insurance or any other government-backed or third party insurance.

Synapse Brokerage and Evolve Bank & Trust Disclosures

The Juno card is issued by Evolve Bank & Trust, Member FDIC, pursuant to license by Mastercard International. Certain services are offered through Synapse Financial Technologies, Inc. and its affiliates (“Synapse”). Brokerage accounts and cash management programs are provided through Synapse Brokerage LLC (“Synapse Brokerage”), an SEC-registered broker-dealer and member of FINRA and SIPC. Additional information about Synapse Brokerage can be found on FINRA’s BrokerCheck. See Synapse Terms of Service, Privacy Policy, and the applicable disclosures and agreements available in Synapse’s Disclosure Library for more information. The Partner Financial Institution(s) participating in a Synapse cash management program are referred to in your Synapse Brokerage Customer Agreement.

Treasury Account Disclosures

Certain services are offered through Jiko Group, Inc. and its affiliates (“Jiko”).

Jiko is a nationally chartered bank and a broker-dealer. Jiko’s technology sweeps customer cash and invests it into US Treasury bills. All brokerage services, US Treasury investments, and investment advisory services provided by Jiko Securities, Inc. a registered broker-dealer, member FINRA and SIPC. Banking services are provided by Jiko Bank, a division of Mid-Central National Bank.

Investments in T-bills: Not FDIC Insured; No Bank Guarantee; May Lose Value.

Investments in T-bills are backed by the full faith and credit of the US government. This material is not intended as a recommendation, offer or solicitation for the purchase or sale of any security or investment strategy. See

FINRA BrokerCheck,

Jiko U.S. Treasuries Risk Disclosures

and

Jiko Securities Inc. Form CRS.

Securities in your account are protected up to $500,000. For details, please see

www.sipc.org.

Jiko Group, Inc. and its affiliates do not provide legal, tax, or accounting advice. You should consult your legal and/or tax advisors before making any financial decisions.

© Copyright 2024 Juno by CapitalJ, Inc